WEEKLY RECAP

- Fed holds rates (4.25%-4.5%), lowers 2025 growth outlook but signals two 2024 cuts.

- U.S. economic weakness: Retail sales fell (-0.9%), housing starts hit 5-year low.

- Global central banks diverge: SNB/Norway cut rates; BoE held; BoJ slowed bond taper.

- Trade tensions flare: U.S.-Japan tariff deal fails; auto tariffs may rise to 24%.

- China’s mixed data: Retail sales jump (6.4%), but property slump deepens.

MAJOR MARKETS

Name

Dow Jones

S&P 500

Nasdaq

Nikkei 225

HSI

SHI

Last Close

42,206.82

5,967.84

19,447.41

38,403.23

23,530.48

3,359.90

7D%

0.02%

-0.15%

0.21%

1.50%

-1.10%

-0.51%

WEEKLY AHEAD

- June 23, 2025, USA, Pending Home Sales

- June 24, 2025, USA, U.S. International Transactions (1st Quarter 2025 and Annual Update)

- June 25, 2025, USA, New Home Sales

- June 26, 2025, USA, Gross Domestic Product (1st Quarter 2025 Third Estimate), GDP by Industry, and Corporate Profits (Revised)

- June 27, 2025, USA, Personal Income and Outlays (May 2025)

- June 30, 2025, China, NBS Manufacturing PMI (June)

- June 30, 2025, USA, U.S. International Investment Position (1st Quarter 2025 and Annual Update)

THOUGHTS OF THE WEEK

Real World Asset (RWA) tokenization, formerly termed Security Token Offerings (STOs), represents the digitization of traditional assets via blockchain technology. At its core, RWA is digital securitization: converting ownership rights to physical assets (e.g., real estate, commodities, bonds) into tradable tokens on a blockchain. For instance, tokenizing a Real Estate Investment Trust (REIT) involves issuing digital tokens representing fractional ownership in property portfolios, mirroring traditional securitization but with blockchain-enabled efficiency (e.g., instant settlement, 24/7 markets). While STOs emerged in 2017–2020 with great promise, they failed to gain traction. This paper explores why STOs faltered, how RWA tokenization has resurged under new conditions, and its potential to reshape crypto and traditional finance.

I. Why STOs Failed

STOs collapsed due to three interconnected flaws:

- Redundancy vs. Traditional Securitization: STOs offered no structural innovation. Tokenized securities mirrored existing instruments (e.g., stocks, bonds) without solving core limitations—high regulatory burdens, illiquidity, and operational inefficiencies. Blockchain reduced transaction costs but could not enhance underlying asset quality.

- Regulatory Ambiguity: Most jurisdictions lacked clear STO frameworks. Projects navigated a patchwork of securities laws, stifling issuance and investor participation. For example, U.S. SEC enforcement actions against unregistered STOs (e.g., TokenLot, 2019) created industry-wide caution.

- Poor Liquidity and Asset Quality: STO markets suffered from fragmented liquidity, with tokens stranded on incompatible platforms. Worse, projects often tokenized low-demand assets (e.g., distressed real estate, speculative ventures) or outright scams, eroding trust. Ultimately, STOs became “solutions in search of a problem,” failing to justify their complexity.

II. Regulatory Aspects: Enabling Institutional Adoption

The Basel crypto-asset regulatory standards and HKMA’s proposed rules classify crypto assets into Group 1 and Group 2 assets:

Defining RWAs as Group 1a Assets:

- Tokenized real-world assets (bonds, real estate, commodities) meeting strict criteria receive traditional-equivalent regulatory treatment.

Clear definitions allow banks, asset managers, and licensed platforms to offer:

- Refinancing: Using RWAs as collateral for low-cost liquidity (e.g., tokenized Treasury bonds pledged for overnight loans).

- Capital Introduction: Connecting institutional investors (pension funds, family offices) with vetted RWA deals.

- Investment Advisory: Structuring compliant RWA portfolios for yield-seeking crypto entities.

STOs (2018–2022)

Ambiguous regulation → banks avoided custody/trading

No refinancing infrastructure → illiquid tokens

Limited investor access → low liquidity

RWAs (2025)

Group 1a status → Goldman Sachs, DBS Bank launch RWA desks

Tokenized collateral accepted for loans (e.g., JP Morgan’s Onyx)

SFC-approved platforms onboard accredited investors

III. Why RWA Tokenization Succeeds Today

RWA has resurged due to symbiotic shifts in crypto markets and regulation:

- Crypto Market Maturation: The crypto ecosystem now boasts a $2.3T market cap (Q2 2025). Institutional players (e.g., hedge funds, family offices) seek diversification within crypto-native environments, creating demand for yield-generating RWAs (e.g., tokenized Treasuries, corporate bonds).

- Regulatory Clarity: Jurisdictions like Hong Kong, Singapore, and the EU have enacted tailored frameworks. Hong Kong’s 2023 virtual asset regime and Basel-compliant capital rules (2025) enable banks to custody tokenized assets, attracting institutional capital and high-quality issuers.

- Stablecoins as Bridging Infrastructure: Stablecoins (e.g., USDC, USDT) provide fiat on-ramps, allowing seamless entry into RWA markets. They enable instant settlement of tokenized asset trades, solving legacy friction.

Crucially, RWAs target crypto-native capital, not the general public. They offer crypto whales and institutions yield diversification within their preferred ecosystem, avoiding traditional finance gatekeeping.

IV. Core Distinction: Purpose-Built for Crypto Ecosystems

While traditional securitization pools assets (e.g., mortgages, loans) into tradable securities for mainstream investors, RWA tokenization is designed for crypto-native capital. This fundamental difference manifests in three ways:

Target Audience:

- Traditional securitization serves fiat-based institutional investors (e.g., pension funds, ETFs).

- RWAs cater to crypto institutions, whales, and DeFi protocols seeking yield within blockchain ecosystems.

Infrastructure Dependence:

- Traditional models rely on legacy systems (SWIFT, DTCC) with slow settlement.

- RWAs leverage stablecoins (e.g., USDC) and permissionless blockchains for instant settlement and 24/7 trading.

Value Proposition:

- Traditional securitization offers diversification outside crypto.

- RWAs provide diversification inside crypto—allowing crypto holders to access real-world yields without exiting the ecosystem.

CHART OF THE WEEK

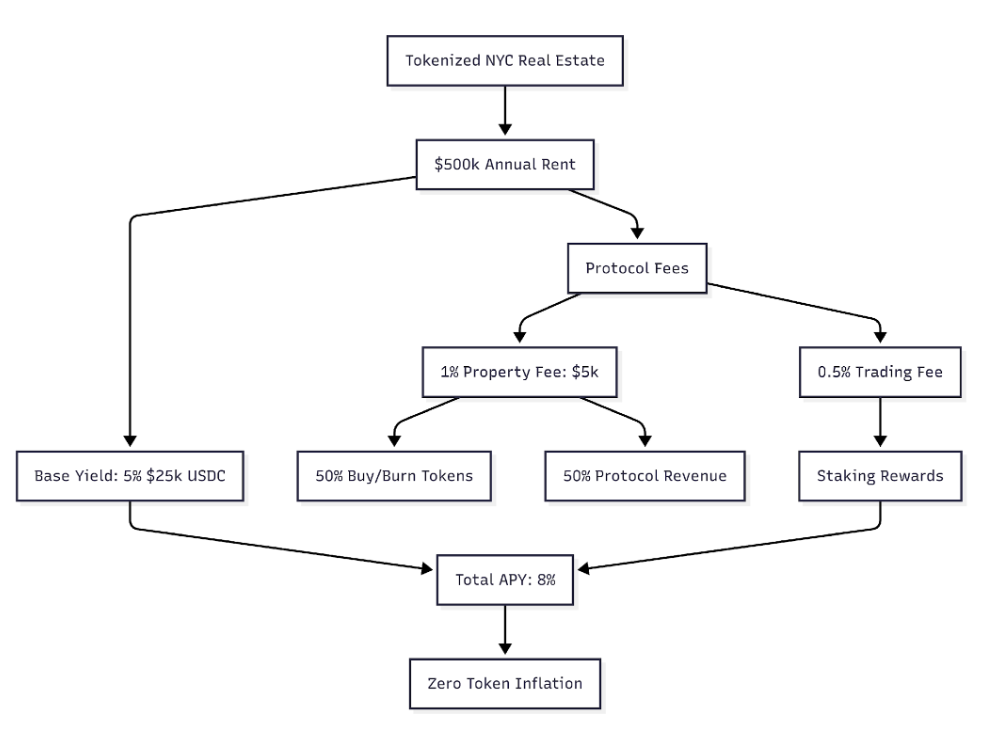

Case Study: Hypothetical RWA Real Estate Vault

Asset: Tokenized NYC apartment building generating $500,000 annual rent.

Tokenomics:

Base Yield: 5% ($500) distributed as USDC from rent. Protocol Rewards: 3% ($300) in governance tokens from platform fees (not inflation):

1% property management fee → 50% used to buy/burn tokens.

0.5% trading fee → distributed as staking rewards.

Result:

Total APY: 8% ($800) with zero token inflation.

Token Demand: Burns and fee-sharing create scarcity, insulating rewards from volatility.

DeFi Composability: The Killer App for RWAs

RWAs transcend traditional securitization by enabling on-chain financial Lego.

Avoiding DeFi’s “Death Spiral”: A Sustainable Yield Model

The user’s example perfectly illustrates DeFi 1.0’s unsustainable yield farming:

“A user deposits $10,000 into a DeFi protocol. The protocol promises 51% APY: $100 (1%) from real interest + $5,000 (50%) in newly minted protocol tokens. When token prices crash, the APY collapses to 1%, triggering mass exits.”

RWAs prevent this via hybrid yield architecture

Sustainable RWA Yield :

Real-World Cash Flow + Fee-Based Token Rewards

V. Conclusion: The Institutional Bridge to Crypto's Next Frontier

RWA tokenization marks a decisive paradigm shift from the failed STO era by aligning with crypto’s institutionalization wave. It succeeds where STOs faltered through three critical drivers:

- Targeting Crypto-Native Demand: Attracting digital asset institutions seeking volatility-resistant diversification

- Leveraging Regulatory & Stablecoin Infrastructure: Basel/HKMA’s Group 1a classification provides legal certainty for institutions to participate – while Group 1b stablecoins enable frictionless settlement.

- Native DeFi Integration: Composability with DeFi/SocialFi to provide a Sustainable Yield Model.

Challenges & Realities:

- Cross-border compliance friction (divergent KYC/tax rules).

- The Permissioned Chain Bias: Basel’s punitive capital treatment for public blockchains (1250% risk weight) will push RWAs toward permissioned ledgers (e.g., JP Morgan Kinexys, HSBC Orion).

Final Verdict: RWAs unlock trillion-dollar assets via regulated, institutional on-ramps – not decentralization. The future: hybrid compliant platforms bridging permissionless & permissioned chains.

DISCLAIMER

DISCLAIMER

Chart of The Week: Sources: Bloomberg, Coindesk, Cointelegraph, Forbes, Rados.io, Linux Research

Market Cap & Trading Vol.: Sources: Coinmarketcap, Linux Research

Thought of The Week: Sources: AON, Bloomberg, Blockchain.com, CCN, Coindesk, Cointelegraph, Ethereum World News, Gemini, Insurance Journal, Los Angeles & San Francisco Daily Journal, Linux Research

Week Ahead: Sources: FxStreet.com, Linux Research

Weekly Recap: Sources: FxStreet.com, Linux Research

Past performance does not guarantee future results.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any cryptocurrencies. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

©Linux Group, October 2024.

Unless otherwise stated, all data is as of October 7, 2024 or as of most recently available.