THOUGHTS OF THE WEEK

This report delves into the Hong Kong Dollar (HKD) and its digital counterpart, the HKD-pegged stablecoin (eHKD), amid Hong Kong’s push toward fintech integration. Drawing on regulatory frameworks from the HKMA and market dynamics, we explore issuance mechanisms, potential imbalances from 1:1 convertibility, associated risks and opportunities, and mitigation approaches. Our analysis aims to provide stakeholders with insights into maintaining monetary integrity while embracing digital advancements.

I. The Foundation: Issuance of HKD and the Linked Exchange Rate System

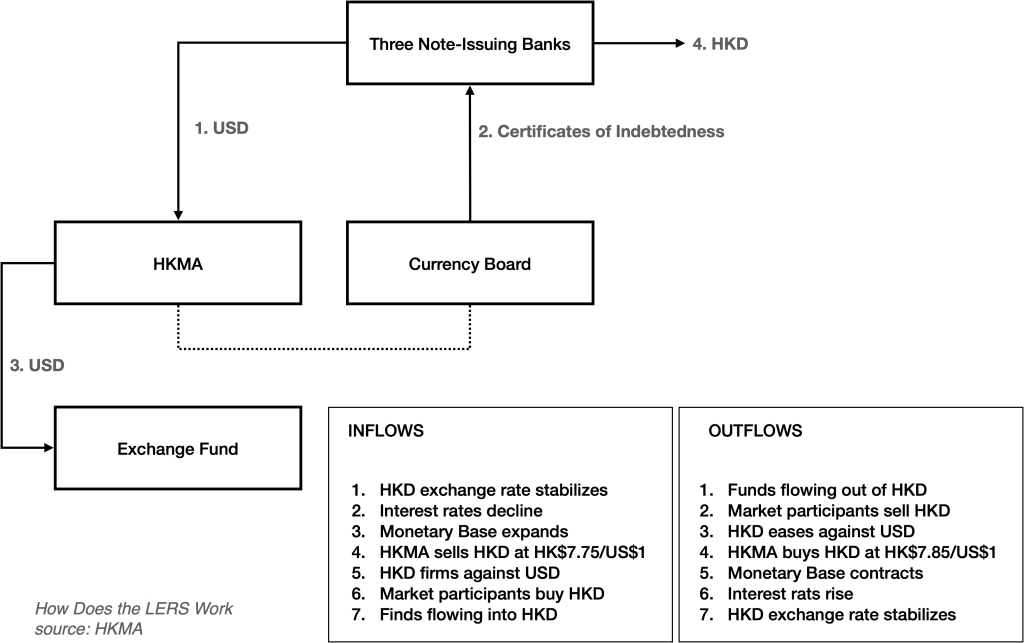

The stability of the physical Hong Kong Dollar is the bedrock of the region’s financial system. Its issuance is not discretionary but is governed by a strict currency board system known as the Linked Exchange Rate System (LERS).

- How HKD is Issued: The HKMA does not “print money” based on economic policy. Instead, the issuance of HKD is directly triggered by capital flows.

- When USD capital flows into Hong Kong, commercial banks credit their customers with HKD and then exchange these USD with the HKMA for Certificates of Indebtedness (COIs), which authorize the issuance of new HKD banknotes. The incoming USD becomes part of Hong Kong’s official reserves.

- Conversely, when USD flows out, the process reverses. HKD is surrendered to the HKMA, which provides USD from its reserves, and the corresponding HKD is retired from circulation.

- The Linked Exchange Rate System (LERS): This mechanism ensures that the entire monetary base of HKD is fully backed by USD reserves held by the HKMA. The exchange rate is fixed at HKD 7.80 = USD 1.00, operating within a convertibility zone of 7.75 to 7.85. The HKMA commits to buying and selling USD at these bands to maintain the peg. In essence, the HKD is a proxy for the US dollar, and its stability is a function of the HKMA’s massive USD reserve holdings.

II. The Innovation: Issuance of a Licensed eHKD Stablecoin

The proposed eHKD represents a digital token, issued by private licensed institutions, that is pegged 1:1 with the HKD. The HKMA’s draft regulatory framework mandates that these stablecoins must be fully backed by reserves of “high quality” and “high liquidity.”

- Licensed Issuers: Unlike the HKD, eHKD would be issued by regulated private entities (e.g., banks, fintechs) granted a stablecoin license.

- The “Unclear Definition” of Reserves: While the HKMA stipulates “high-quality, liquid assets,” the precise composition is not explicitly limited to USD assets. This opens the possibility for licensees to back eHKD with a basket that could include:

- USD Cash & Treasuries: The safest, most liquid option, mirroring the HKD’s own backing.

- Other Sovereign Bonds (e.g., Chinese Government Bonds): High-quality but carrying different interest rate and credit risks.

- Offshore RMB (CNH): A liquid currency but with its own exchange rate volatility against the USD. This ambiguity in reserve composition is the source of pot.

III. The Core Friction: The Arbitrage Condition of a 1:1 Peg

If the HKMA mandates that eHKD and HKD must be convertible at 1:1, but allows their reserve backings to differ, an inherent arbitrage condition is created. There will always be scenarios where issuing one currency is economically easier or more profitable than the other, depending on the relative value of their underlying assets.

Example 1: CNH Depreciation vs. USD

- Scenario: The Offshore RMB (CNH) experiences significant depreciation against the US dollar. An eHKD issuer whose reserves are heavy in CNH now sees the USD-value of its reserve pool decline. However, due to the 1:1 peg, holders can still redeem one eHKD for one HKD, which is itself fully convertible to USD.

- Threat to Monetary System: This creates a “weakest link” problem. Rational actors will engage in arbitrage: sell (depressing) eHKD for HKD, and convert HKD to USD via the LERS. This places simultaneous redemption pressure on the eHKD issuer (forcing a fire-sale of depreciating CNH assets) and on the HKMA (defending the HKD peg by selling USD reserves). The stability of the entire system is compromised by the weaker asset in the eHKD reserve basket.

- Opportunity for Investors: Astute investors can short CNH or buy USD/HKD while simultaneously redeeming eHKD for HKD, capturing the value difference in a near-risk-free trade at the expense of the eHKD issuer and the monetary system.

Example 2: Diverging Interest Rates

- Scenario: US interest rates are low, while Chinese bond yields are high. An eHKD issuer can generate a higher yield by backing its stablecoin with Chinese government bonds compared to the meager yield from US Treasuries.

- Threat to Monetary System: The eHKD issuer has an incentive to issue as much eHKD as possible to capture this yield spread. This could lead to an over-issuance of eHKD not constrained by USD inflows, potentially creating inflationary pressure within the digital HKD ecosystem and decoupling its credit conditions from the physical HKD governed by the LERS.

- Opportunity for Investors: Investors seeking yield would flock to hold eHKD from this high-yielding issuer, or to platforms offering lending services with eHKD, creating a credit boom in the digital sphere that is disconnected from the traditional HKD monetary base.

IV. Mitigating the Risks: A Three-Pronged Evaluation

To manage these risks, several theoretical solutions have been proposed.

- Restricted Application Scenario

- Mechanism: Limit eHKD use to specific, walled-garden applications (e.g., settling tokenized assets, in-game purchases, government voucher systems) where direct conversion to HKD is difficult or disallowed.

- This approach effectively contains systemic risk by ring‑fencing the eHKD ecosystem; however, it may hinder adoption by preventing the eHKD from serving as a universal form of digital cash.

- Allowing eHKD to be Traded Freely

- Mechanism: Abandon the hard 1:1 peg and let the market determine the exchange rate between eHKD and HKD based on the perceived value and risk of the eHKD’s reserves.

- Evaluation: This instantly eliminates the arbitrage problem, as the market prices in the risk. However, it fundamentally transforms the eHKD from a stablecoin into a volatile crypto-asset. It would no longer be fit for purpose as a medium of exchange or a store of value, creating consumer confusion and potential losses.

- Introducing a Significant Conversion Fee

- Mechanism: Impose a fee on conversions between eHKD and HKD, creating a “no-arbitrage band” wider than any potential value discrepancy.

- Evaluation: This is theoretically effective at deterring arbitrage but practically unworkable. High fees destroy the utility of eHKD for payments and settlements, its primary value proposition. It would also encourage the growth of an unregulated secondary market to circumvent the fees.

V. Conclusion: A Conservative but Positive Path Forward

A prudent conclusion is that the Hong Kong Monetary Authority (HKMA) will likely require eHKD reserves to be predominantly backed by U.S. dollar assets, mirroring the physical HKD. This alignment ensures the eHKD carries the same risk profile, integrates seamlessly with the existing monetary system, and prevents destabilizing arbitrage—or, in more restricted scenarios, ring‑fences systemic risk within the eHKD ecosystem.

At the same time, this conservative foundation does not stifle innovation. Licensed institutions can still compete by offering advanced wallets, programmable payments, and integration with tokenized assets. Anchored to the robustness of the HKD, the eHKD can enable Hong Kong to foster a dynamic digital finance ecosystem and strengthen its position as a leading global financial centre in the digital era.

DISCLAIMER

Chart of The Week: Sources: Bloomberg, Coindesk, Cointelegraph, Forbes, Rados.io, Linux Research

Market Cap & Trading Vol.: Sources: Coinmarketcap, Linux Research

Thought of The Week: Sources: AON, Bloomberg, Blockchain.com, CCN, Coindesk, Cointelegraph, Ethereum World News, Gemini, Insurance Journal, Los Angeles & San Francisco Daily Journal, Linux Research

Week Ahead: Sources: FxStreet.com, Linux Research

Weekly Recap: Sources: FxStreet.com, Linux Research

Past performance does not guarantee future results.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any cryptocurrencies. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

©Linux Group, October 2024.

Unless otherwise stated, all data is as of October 7, 2024 or as of most recently available.