Payment Technology | Linux Group

Redefining Cross-Border Payments for a Connected World

Engineer frictionless, multi-currency transactions with Linux Group’s scalable payment infrastructure and developer-first APIs.

Modernize Credit Card Programs with API-First Infrastructure

Deploy physical/virtual credit cards in days — not months — with embedded rewards, compliance, and real-time liquidity management for fintechs, banks, and brands.

- E-money

- Mobile Money

- Credit Card

- Debit Card

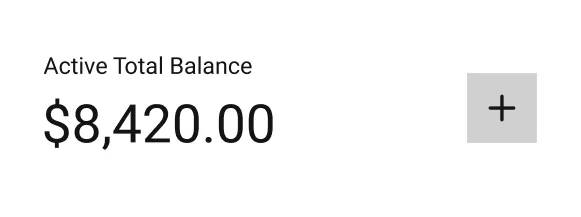

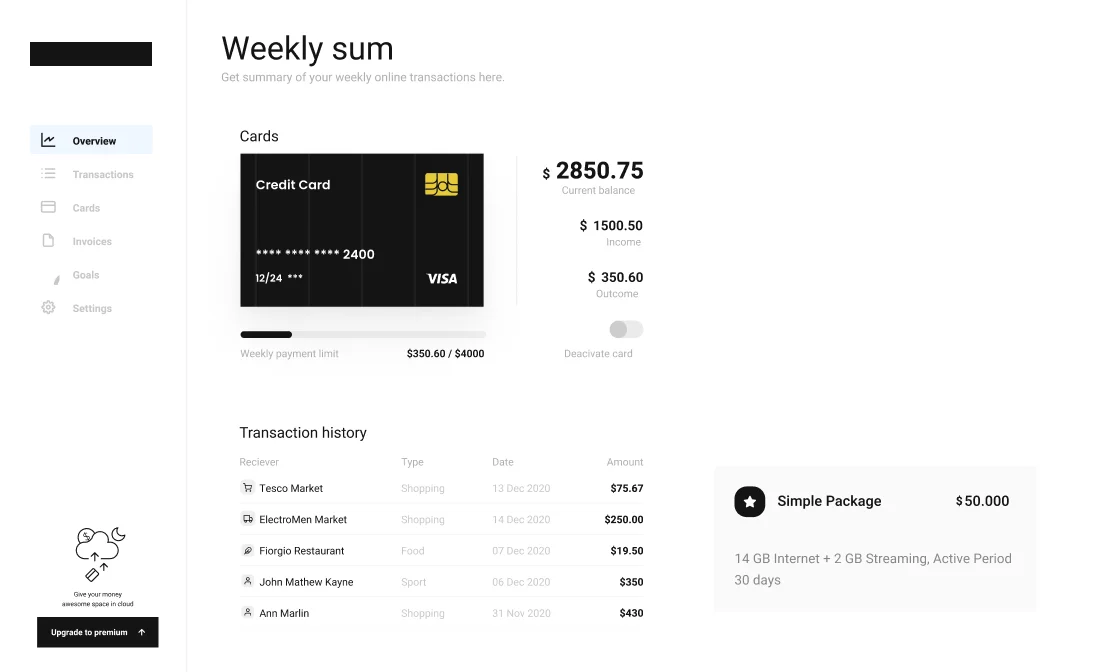

One dashboard for all business financial needs

Aggregate bank accounts, payment gateways, crypto wallets, and ERP data into a unified dashboard — powered by predictive analytics and real-time decisioning tools

Easy to use

Secure

Credit Card API

Scalable Integration Frameworks

Developer-Centric Tools

Unified Ecosystem Connectivity

Payment Infrastructure

- Global Payment Orchestration

- Real-Time Settlement

- Frictionless Crypto Conversion

Compliance System

Regulatory Automation

Asset Custody & Security

Lifecycle Governance

Capital Borderless

Free from financial constraints to access a world of opportunities.

Simplify your financial trancasction today!

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam

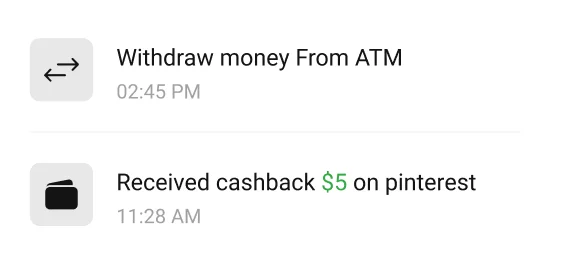

How Level Payment works

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam

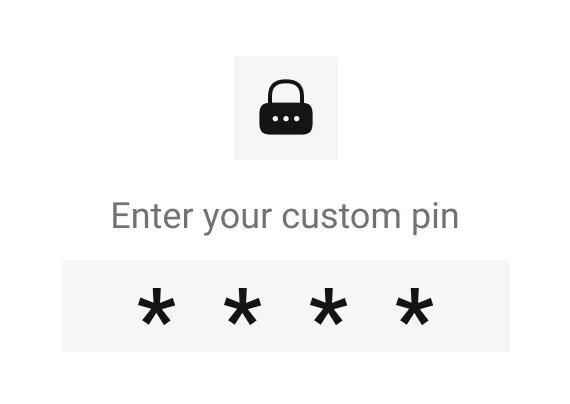

Pin customization

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam

Flexible Interface

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam

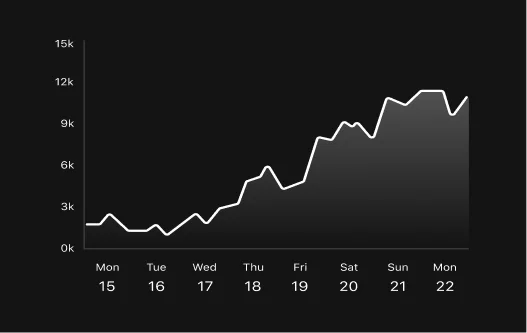

Payment Tracking

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam

One dashboard for all business financial needs

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam.

Easy to use

Super safe

FAQ: Linux Payment Technology

Integrating with your existing ERP or accounting software

- Encryption: AES-256 for data at rest/in transit.

- Authentication: FIDO2 standards, biometric logins, and MPC (multi-party computation) for crypto transactions.

- Fraud Prevention: AI-driven anomaly detection, 3DS2 compliance, and hardware-isolated key storage.

Yes. Our pre-built connectors sync with QuickBooks, SAP, NetSuite, Xero, and custom ERPs. Use our REST API or no-code UI to map data fields, ensuring real-time reconciliation of P&L, AR/AP, and balance sheets.

Our platform auto-converts currencies at interbank rates with <1% spread. Hedge FX exposure using forward contracts or stablecoin settlements, and simulate scenarios via our treasury dashboard.

We enforce GDPR, PSD2/SCA, FATF Travel Rule, and OFAC sanctions by default. Jurisdiction-specific modules (e.g., MAS TRM for Singapore, NYDFS for the U.S.) can be activated via API.

- Sandbox Access: Instant setup for testing.

- Production Deployment: 3–7 days using pre-built SDKs (Python, Node.js, Java) and no-code templates for common use cases (e.g., e-commerce payouts).