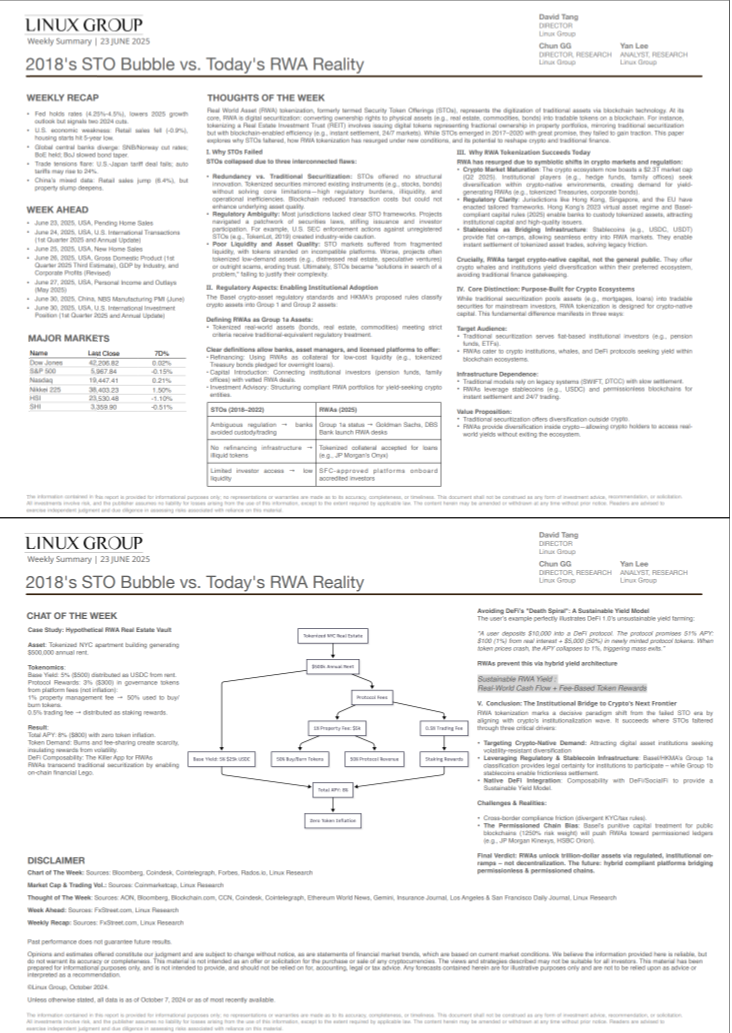

Real World Asset (RWA) tokenization, formerly termed Security Token Offerings (STOs), represents the digitization of traditional assets via blockchain technology. At its core, RWA is digital securitization: converting ownership rights to physical assets (e.g., real estate, commodities, bonds) into tradable tokens on a blockchain. For instance, tokenizing a Real Estate Investment Trust (REIT) involves issuing digital tokens representing fractional ownership in property portfolios, mirroring traditional securitization but with blockchain-enabled efficiency (e.g., instant settlement, 24/7 markets). While STOs emerged in 2017–2020 with great promise, they failed to gain traction. This paper explores why STOs faltered, how RWA tokenization has resurged under new conditions, and its potential to reshape crypto and traditional finance.

To get the full report, please contact us at [email protected]