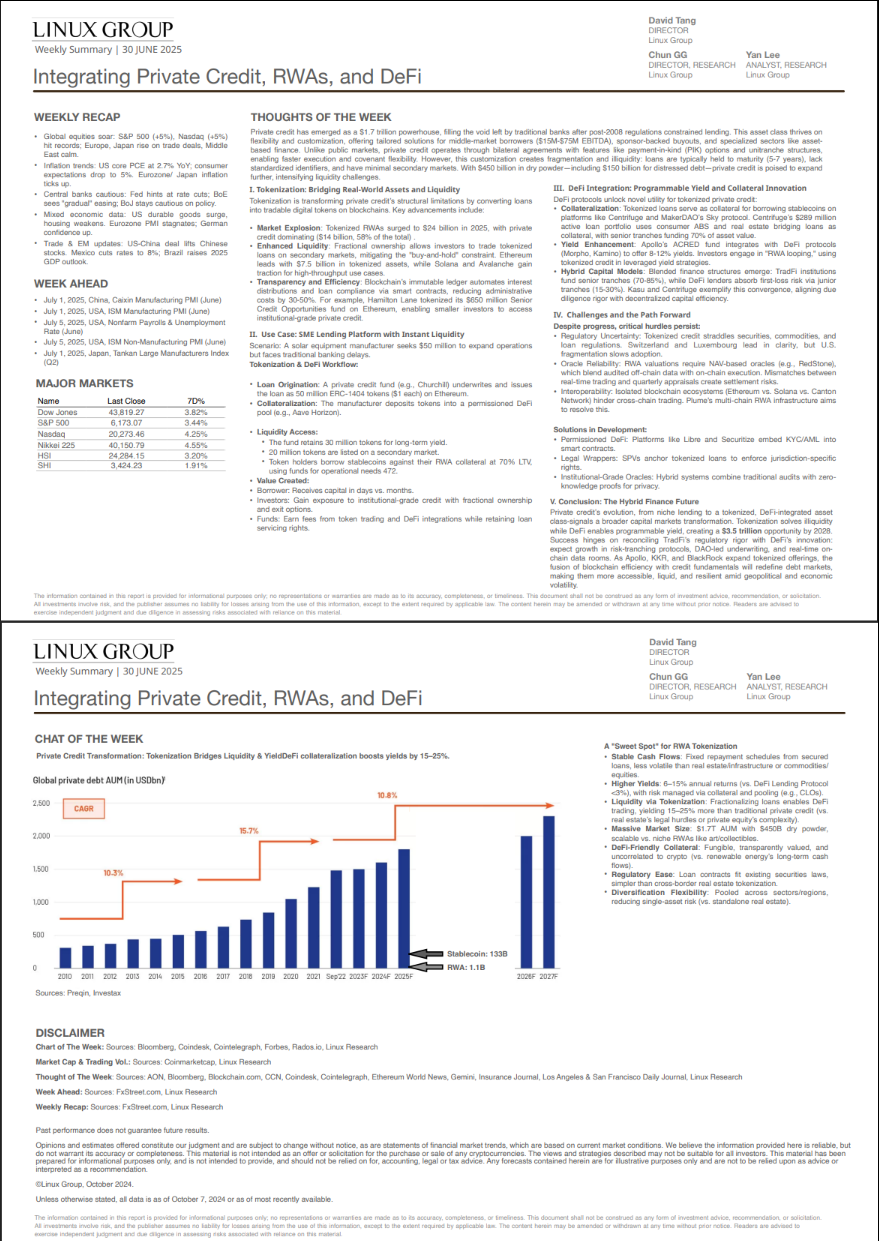

Private credit has emerged as a $1.7 trillion powerhouse, filling the void left by traditional banks after post-2008 regulations constrained lending. This asset class thrives on

flexibility and customization, offering tailored solutions for middle-market borrowers ($15M-$75M EBITDA), sponsor-backed buyouts, and specialized sectors like assetbased finance. Unlike public markets, private credit operates through bilateral agreements with features like payment-in-kind (PIK) options and unitranche structures,

enabling faster execution and covenant flexibility. However, this customization creates fragmentation and illiquidity: loans are typically held to maturity (5-7 years), lack

standardized identifiers, and have minimal secondary markets. With $450 billion in dry powder—including $150 billion for distressed debt—private credit is poised to expand

further, intensifying liquidity challenges.

To get the full report, please contact us at [email protected]