WEEKLY RECAP

- U.S. stocks rose ~3%, driven by strong jobs data and upbeat earnings.

- Q1 U.S. GDP shrank 0.3%, but spending and hiring stayed strong.

- Oil prices fell; Bitcoin neared $100K on crypto optimism.

- Global markets gained amid easing trade tensions.

- Markets await Fed’s May meeting for rate signals

MAJOR MARKETS

Name

Dow Jones

S&P 500

Nasdaq

Nikkei 225

HSI

SHI

Last Close

41,317.43

5,686.67

17,977.73

36,830.69

22,504.68

3,279.00

7D%

2.96%

3.56%

4.52%

4.86%

1.92%

-0.61%

WEEKLY AHEAD

- May 9, 2025, U.S. Bureau of Labor Statistics, Consumer Price Index (CPI)

- May 6–7, 2025, Federal Reserve, FOMC Meeting and Policy Statement

- May 6, 2025, NBS, Caixin Composite PMI (April)

- May 7, 2025, People’s Bank of China, Foreign Exchange Reserves (April)

- May 9, 2025, General Administration of Customs, Balance of Trade (April)

- May 8, 2025, Ministry of Finance, 10-Year JGB Auction

- May 8, 2025, Ministry of Finance, 6-Month Bill Auction

- May 9, 2025, Ministry of Finance, 30-Year JGB Auction

THOUGHTS OF THE WEEK

In a world of geopolitical gambits and policy shocks, Berkshire Hathaway’s 2025 AGM offered a masterclass in disciplined investing. Warren Buffett and Greg Abel outlined a playbook for navigating uncertainty—prioritizing structural resilience over speculation, leveraging cash as a strategic weapon, and embracing global opportunities from Tokyo to Texas. This week, we distill key lessons from Omaha: why Japan’s undervalued giants captivate Buffett, how AI is reshaping risk without replacing human judgment, and what Abel’s imminent CEO role signals for Berkshire’s future. Amid rising fiscal risks and market euphoria, we translate timeless wisdom into actionable strategies—because in 2025’s climate, preparation isn’t just prudent—it’s profitable.

I. Strategic Cash Deployment & Market Patience

Record Cash Reserves: Berkshire holds ~$335B in cash/short-term Treasuries, a “fortress balance sheet” to capitalize on major opportunities.

Key Insight

Actionable

Cash is a strategic asset, not idle capital. Expect aggressive deployment during market dislocations (e.g., 2008-style crises).

Maintain liquidity to seize “fat pitches” in undervalued sectors (e.g., energy, infrastructure)

Japan as a Blueprint: Berkshire’s $20B investment in 5 Japanese trading firms (Mitsubishi, Itochu, etc.) exemplifies long-term, value-driven bets.

Key Insight

Actionable

Focus on companies with durable cash flows, low valuations, and shareholder-friendly policies (e.g., buybacks).

Explore undervalued international markets with structural tailwinds (e.g., Japan’s corporate governance reforms).

II. Insurance: Resilience & Innovation

GEICO Turnaround: Combined ratio improved to 80% (vs. industry ~100%) via cost cuts, telematics, and risk-based pricing.

Key Insight

Actionable

Operational discipline + tech adoption (AI/telematics) can transform legacy businesses.

Invest in insurers leveraging data/AI to optimize pricing and claims (e.g., Progressive, Lemonade).

AI & Autonomous Vehicles: AI will reshape risk assessment, but human judgment remains irreplaceable (AI Vs Ajit: Warren chooses Ajit).

Key Insight

Actionable

Operational discipline + tech adoption (AI/telematics) can transform legacy businesses.

Invest in insurers leveraging data/AI to optimize pricing and claims (e.g., Progressive, Lemonade).

III. Macro Risks & Fiscal Discipline

Currency & Debt Concerns: Buffett warned of U.S. fiscal deficits (7% GDP) as a systemic risk.

Key Insight

Actionable

Long-term currency debasement favors hard assets (equities, real estate) over cash/bonds.

Hedge USD exposure via international equities (e.g., Japan, India) and commodities.

Energy Infrastructure: U.S. grid modernization requires $trillions. Berkshire seeks public-private partnerships but faces regulatory hurdles.

Key Insight

Actionable

Utilities/energy firms with scale (e.g., Berkshire Energy) will dominate, but policy risks persist.

Focus on companies with regulatory moats and inflation-linked pricing (e.g., NextEra Energy).

IV. Investment Philosophy

Patience + Opportunism: “Turn every page” to find mis-priced assets (e.g., Buffett’s Japanese trading co. discovery).

Key Insight

Actionable

Avoid FOMO; wait for asymmetric risk/reward setups (e.g., 2008-09, March 2020).

Build watchlists of high-quality companies and strike during panic (e.g., sector-wide selloffs).

Avoid “Casino” Mentality: Favor businesses with compounding cash flows (Apple, Coca-Cola) over speculative bets (crypto, meme stocks).

Key Insight

Actionable

Compounding cash flow businesses grow intrinsic value regardless of market sentiment, unlike speculative assets

Dedicate 80%+ of equity holdings to businesses with proven compounding engines. Limit speculative bets to <5%.

CHART OF THE WEEK

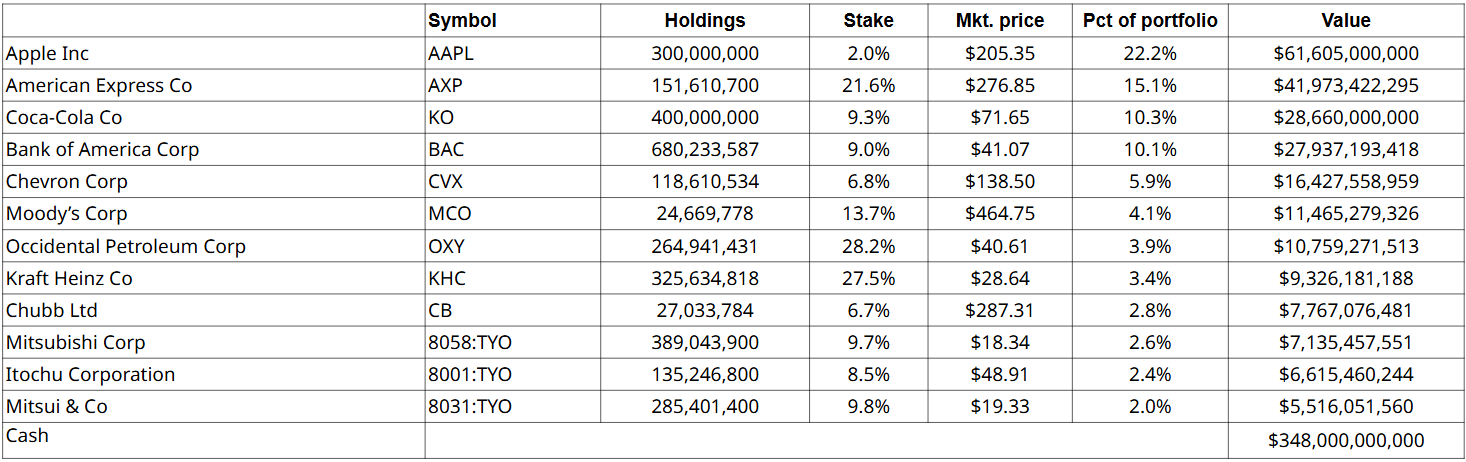

Berkshire Hathaway’s $277.4 billion equity portfolio, anchored by iconic holdings like Apple and Coca-Cola, is now paired with a record-breaking $347.7 billion in cash reserves—a strategic war chest underscoring its cautious yet opportunistic stance in today’s markets. Simultaneously, the conglomerate has deepened its **strategic foothold in Japan**, ramping up investments in undervalued sectors through stakes in major trading firms like Mitsubishi, Itochu, and Mitsui. This dual emphasis on liquidity preservation and targeted international growth highlights Berkshire’s disciplined approach to balancing risk and reward amid global economic uncertainty.

Building Resilience in Evolving Markets

In light of evolving market dynamics, we advocate a proactive strategy that prioritizes liquidity to capitalize on potential corrections, particularly in high-conviction sectors like energy transition, AI infrastructure, and undervalued Japanese equities. Geopolitical diversification is critical—reduce USD concentration through selectively hedged exposure to structurally resilient markets, including Japan’s corporate reform-driven equities, India’s demographic dividend, and EM exporters benefiting from supply chain shifts. Focus on leadership teams with proven capital discipline, such as Berkshire Hathaway under Greg Abel’s operational rigor or Apple’s ecosystem-driven capital allocation under Tim Cook, to mitigate execution risk. Simultaneously, hedge against fiscal volatility by overweighting equities with pricing power (e.g., infrastructure-heavy industrials), real assets (e.g., regulated utilities), and select commodities tied to decarbonization. As Warren Buffett emphasizes, “The best defense is a good offense—and cash is the ultimate offense”: maintain dry powder to exploit dislocations while anchoring portfolios in cash-generative businesses that compound through cycles.

DISCLAIMER

Chart of The Week: Sources: Bloomberg, Coindesk, Cointelegraph, Forbes, Rados.io, Linux Research

Market Cap & Trading Vol.: Sources: Coinmarketcap, Linux Research

The horizontal axis represents the week number in 2018. For instance, W21 indicates the twenty first week in 2018. The primary vertical axis represents total market capitalization; and the secondary vertical axis represents total trading volume.

Thought of The Week: Sources: AON, Bloomberg, Blockchain.com, CCN, Coindesk, Cointelegraph, Ethereum World News, Gemini, Insurance Journal, Los Angeles & San Francisco Daily Journal, Linux Research

Week Ahead: Sources: FxStreet.com, Linux Research

Weekly Recap: Sources: FxStreet.com, Linux Research

Past performance does not guarantee future results.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any cryptocurrencies. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

©Linux Group, October 2024.

Unless otherwise stated, all data is as of October 7, 2024 or as of most recently available.