WEEKLY RECAP

- Central banks stayed cautious, with key speeches awaited for guidance amid inflation uncertainty.

- Eurozone and UK inflation remained elevated, while retail sales softened in the UK.

- Oil prices fell on weak demand forecasts; the US dollar strengthened amid safe-haven flows.

- US-China tariff pause boosted markets but uncertainty over lasting trade progress remains.

MAJOR MARKETS

Name

Dow Jones

S&P 500

Nasdaq

Nikkei 225

HSI

SHI

Last Close

41,603.07

5,802.82

18,737.21

37,160.47

23,601.26

3,348.37

7D%

-2.53%

-2.68%

-2.53%

-0.81%

1.09%

-0.56%

WEEKLY AHEAD

- May 27, 2025, China National Bureau of Statistics, Foreign Direct Investment (FDI) YoY

- May 30, 2025, Japan Ministry of Economy, Trade and Industry, Industrial Production MoM (Preliminary)

- May 30, 2025, Japan Ministry of Economy, Trade and Industry, Retail Sales YoY

- May 31, 2025, China National Bureau of Statistics, Industrial Profits (YTD) YoY

- May 31, 2025, China National Bureau of Statistics, Manufacturing PMI

- May 31, 2025, China National Bureau of Statistics, Non-Manufacturing PMI

THOUGHTS OF THE WEEK

In an era defined by fiscal uncertainty, sovereign debt explosions, and escalating trade tensions, Bitcoin has emerged as a paradoxical force: a volatile digital asset demonstrating remarkable resilience. As governments worldwide grapple with unsustainable debt trajectories—exemplified by the U.S.’s $3.8 trillion tax-cut debate and fears of Treasury oversupply—investors are increasingly turning to Bitcoin as both a speculative bet and a hedge against systemic risks. This article explores Bitcoin’s evolving role in global markets, focusing on its recent decoupling from traditional equities during tariff disputes, its correlation with macroeconomic liquidity trends, and its growing acceptance as a portfolio diversifier.

Fiscal Instability and the Case for Scarcity

Global investors face a precarious landscape. In the U.S., concerns over deficit-driven Treasury issuance have reached a boiling point. Bank of America recently warned that a surge in bond supply could spike interest rates, weaken the dollar, and destabilize equities—risks amplified by the Federal Reserve’s commitment to maintaining elevated rates. Meanwhile, the Congressional Budget Office projects that Trump’s proposed tax cuts could add $2.8 trillion to the U.S. deficit over a decade, exacerbating long-term debt sustainability fears.

This fiscal recklessness is not isolated. Governments globally are prioritizing short-term political survival over long-term stability, fueling currency debasement. For investors, this environment underscores the urgency of allocating to scarce assets. Bitcoin, with its fixed supply of 21 million coins, stands out as a natural candidate.

Bitcoin’s Breakout: Institutional Adoption Meets Regulatory Clarity

Bitcoin’s recent surge to $109,500—a 16% gain in May 2024—reflects three transformative drivers:

- Institutional Demand: Spot Bitcoin ETFs, such as BlackRock’s IBIT ($58 billion AUM), have democratized access, funneling $1.8 billion into crypto markets in three weeks.

- Regulatory Tailwinds: The U.S. Senate’s passage of the Stablecoin Transparency Act and Texas’s Bitcoin Strategic Reserve Bill signal growing legitimacy, encouraging corporate adoption (e.g., MicroStrategy’s $15 billion Bitcoin treasury).

- Global Liquidity Waves: Central banks outside the U.S. continue easing policies, boosting liquidity-sensitive assets.

Critically, Bitcoin’s appeal extends beyond speculation. Studies by Morningstar and BlackRock highlight its portfolio benefits: a 5% Bitcoin allocation increases the Sharpe ratio of a 60/40 stock-bond portfolio from 0.77 to 0.96, enhancing risk-adjusted returns by 25%.

Risks: Volatility, Regulation, and the Rebalancing Dilemma

Bitcoin’s ascent is not without hurdles:

- Volatility: Intra-year swings of 20–30% test investor resolve.

- Regulatory Fragmentation: While the U.S. progresses, the EU’s stringent anti-money laundering rules create compliance complexity.

- Rebalancing Challenges: Morningstar warns that a 1% Bitcoin allocation could balloon to 60% without disciplined rebalancing—a logistical nightmare for traditional portfolios.

The Tariff Test: Bitcoin’s Decoupling from Equities

A pivotal shift occurred during recent U.S.-China tariff escalations. While the S&P 500 wobbled under fears of trade-war-driven inflation and supply chain disruptions, Bitcoin exhibited striking resilience, gaining 12% as investors fled to alternatives. This decoupling challenges the long-held view that Bitcoin correlates closely with risk assets.

Analysts attribute this divergence to Bitcoin’s unique positioning:

- Hedge Against Policy Volatility: Tariff disputes amplify macroeconomic uncertainty, driving demand for assets perceived as “policy-neutral.”

- Liquidity Refuge: As trade tensions strained dollar liquidity, Bitcoin’s global, decentralized nature offered shelter.

- Institutional Reassessment: J.P. Morgan CEO Jamie Dimon’s reluctant endorsement (“I’ll defend your right to buy Bitcoin”) reflects Wall Street’s grudging acknowledgment of its diversification power.

This resilience mirrors Bitcoin’s behavior during the 2020 pandemic crash, where it recovered faster than equities, cementing its role as a crisis asset.

The 60/40 Portfolio Needs Bitcoin In Today’s Market

The classic 60/40 portfolio is faltering as bonds fail to hedge against inflation and equities face fiscal uncertainty. With negative real bond yields and rising rate sensitivity, alongside equity valuations strained by debt-driven volatility, the strategy’s risk buffer has collapsed. Bitcoin’s non-correlation to traditional assets and scarcity (capped at 21 million) offers a critical hedge against currency debasement and liquidity shocks.

Adding 1–5% Bitcoin historically boosts risk-adjusted returns — a 2024 Morningstar study showed a 25% higher Sharpe ratio—while its asymmetric upside offsets short-term volatility. Automation tools now ease rebalancing hurdles, maintaining portfolio stability.

In a world of reckless fiscal policy (global debt-to-GDP > 335%) and M2-driven liquidity swings, Bitcoin’s macro sensitivity and fixed supply make it indispensable. It’s no longer speculative; it’s structural insurance for modern portfolios.

CHART OF THE WEEK

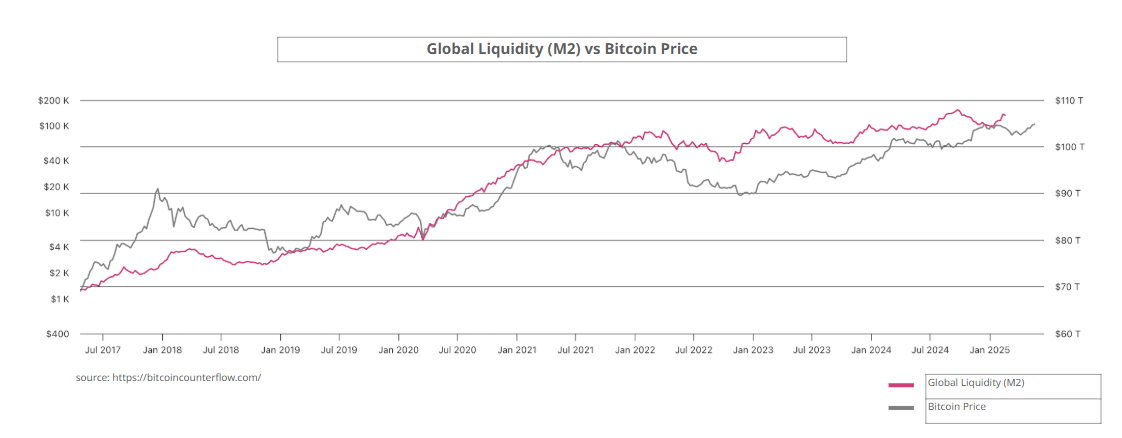

The M2 Paradox: Liquidity’s Double-Edged Sword

The relationship between Bitcoin and the Global M2 money supply hinges on liquidity’s role as a macroeconomic tide. M2, which measures cash, checking deposits, and easily convertible near-money, reflects the aggregate liquidity injected by central banks. When lagged by 90 days, this metric often signals shifts in capital availability—liquidity that eventually seeks yield in risk assets like Bitcoin.

Bitcoin’s price remains tethered to global liquidity trends, particularly the Global M2 Money Supply (lagged 90 days). Since February 2024, a 3.25% rise in M2 preceded Bitcoin’s rally, echoing patterns from the 2021 bull run. However, this correlation is imperfect. Year-to-date, Bitcoin has gained 8% despite a 0.16% dip in lagged M2—a disconnect highlighting external catalysts like ETF inflows and regulatory shifts.

Julien Bittel of Global Macro Investor argues that M2 remains a critical narrative anchor: “The liquidity story still holds; we’re going higher.” Yet, Bitcoin’s 75% surge over 12 months (vs. M2’s 3.8% rise) suggests its value transcends mere liquidity tracking.

DISCLAIMER

Chart of The Week: Sources: Bloomberg, Coindesk, Cointelegraph, Forbes, Rados.io, Linux Research

Market Cap & Trading Vol.: Sources: Coinmarketcap, Linux Research

Thought of The Week: Sources: AON, Bloomberg, Blockchain.com, CCN, Coindesk, Cointelegraph, Ethereum World News, Gemini, Insurance Journal, Los Angeles & San Francisco Daily Journal, Linux Research

Week Ahead: Sources: FxStreet.com, Linux Research

Weekly Recap: Sources: FxStreet.com, Linux Research

Past performance does not guarantee future results.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any cryptocurrencies. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

©Linux Group, October 2024.

Unless otherwise stated, all data is as of October 7, 2024 or as of most recently available.