WEEKLY RECAP

- U.S. stocks up again: Major indexes rose for 2nd week (Russell 2000 +3.2%, Nasdaq +2.2%), led by tech/AI optimism.

- U.S. jobs resilient: May payrolls (+139K) beat expectations; unemployment steady at 4.2%.

- U.S. activity cools: Manufacturing PMI contracts (48.5), services PMI dips into contraction (49.9).

- ECB cuts rates: Lowered deposit rate to 2% (as expected), signaled pause after 8 cuts since 2024.

- Trade tensions ease: Trump-Xi call yielded “positive” outcome after earlier escalation; China data weak (Caixin PMI 48.3).

WEEKLY AHEAD

- June 9, 2025, China National Bureau of Statistics, Inflation Rate

- June 9, 2025, China National Bureau of Statistics, Producer Price Index (PPI)

- June 9, 2025, China General Administration of Customs, Balance of Trade

- June 11, 2025, United States Bureau of Labor Statistics, Consumer Price Index (CPI) Monthly and Annual

- June 13, 2025, Germany Federal Statistical Office, Consumer Price Index (CPI)

MAJOR MARKETS

Name

Dow Jones

S&P 500

Nasdaq

Nikkei 225

HSI

SHI

Last Close

42,762.87

6,000.36

19,529.95

37,741.61

23,792.54

3,385.36

7D%

1.15%

1.48%

2.13%

-0.59%

2.11%

1.12%

THOUGHTS OF THE WEEK

Stablecoins have evolved from niche crypto tools to foundational financial infrastructure, with the market capitalization surging from $20 billion in 2020 to $246 billion in 2024. Recent developments—including Circle’s landmark IPO and Tether’s record-breaking $13 billion profit in 2024—underscore their commercial viability. As regulatory frameworks crystallize in the U.S. (Genius/STABLE Acts) and Hong Kong, stablecoins are transitioning from speculative instruments to regulated financial products with transformative potential. This analysis examines regulatory divergence and the emerging business models capitalizing on this shift.

I. Regulatory Frameworks: U.S. and Hong Kong Approaches

United States: Dollar-Centric Legislation

- Genius Act (Senate-Passed): Mandates 1:1 reserves exclusively in U.S. Treasuries (<93 days), cash, or insured deposits. Nonbank issuers require OCC approval, with monthly audits and CEO/CFO attestations. Designed to channel global liquidity into U.S. debt markets.

- STABLE Act (House Proposal): Adds prohibitions on interest payments to holders and requires FinCEN-led AML rules. Preempts state licensing but permits foreign issuers under “comparable regimes.”

- Political Momentum: The Genius Act passed the Senate (66-32) in May 2025, with strong White House support aiming for enactment by August. Critics cite insufficient consumer protections and potential conflicts of interest.

Hong Kong: Flexible Innovation Hub

- Licensing Regime (Effective Late 2025): Requires licenses for issuers of “specified stablecoins” (fiat-pegged, excluding CBDCs), with severe penalties (HK$5M fines, 7-year imprisonment) for violations.

- Core Requirements:

- 100% high-quality liquid reserves (flexible for USD/HKD pairs).

- Redemption within 1 business day.

- Minimum HK$25M capital (banks exempted).

- Mandatory AML checks for transactions ≥HK$8,000.

- Innovation Safeguards: Establishes a Stablecoin Review Tribunal for appeals and includes crypto platforms as “permitted offerers,” facilitating market access.

II. Comparative Regulatory Analysis: Diverging Philosophies

Dimension

Reserve Assets

Geopolitical Goal

Capital Requirements

Redemption Speed

Market Access

U.S. Approach

U.S.-only: T-bills, cash, insured deposits

Cement dollar dominance

Not specified (bank-centric)

Unspecified

Bank/OCC-approved entities only

Hong Kong Approach

Global high-quality assets (incl. debt securities)

Enhance financial hub competitiveness

HK$25M minimum (exempts banks)

1 business day mandate

Open to companies/institutions (inc. offshore)

Key Insight: The U.S. leverages stablecoins as tools of monetary policy, prioritizing Treasury demand. Hong Kong focuses on market agility, balancing rigor with ecosystem growth.

III. Use Cases and Market Evolution

Stablecoins now transcend crypto trading, enabling:

- Cross-Border Efficiency: Processing $27.6 trillion in 2024—outpacing Visa/Mastercard—with remittance costs 80% lower than traditional networks.

- Institutional On-Ramps: Serving as primary fiat gateways for exchanges and DeFi protocols (e.g., 83% of crypto trades involve stablecoins).

- Programmable Treasury Tools: Enterprises use stablecoins for real-time settlements and automated liquidity management.

- Emerging Store of Value: Privacy features and inflation hedging drive adoption in volatile economies.

Regulatory Impact: Treating issuers as “digital banks” (via reserve mandates) legitimizes the sector but risks consolidating power among compliant giants like Tether and Circle.

IV. Business Models and Revenue Opportunities

- Issuance and Reserve Management

- Treasury Arbitrage: Tether’s $113 billion U.S. Treasury portfolio generated $7 billion in 2024 profits from yield spreads.

- Scale Advantages: Circle’s IPO valuation ($7B+) reflects investor confidence in fee-based models (0.1-0.3% transaction fees on $45B annual issuance).

- Excess Reserves: Tether’s $7B+ reserve buffer enables strategic investments (AI, mining, renewables) while backing tokens.

- Integrated Financial Services

- Banking-as-a-Service: Licensed issuers can embed wallets, payments, and custody (e.g., El Salvador licensing Tether as a digital asset provider).

- DeFi Integration: Interest-bearing stablecoins (e.g., MakerDAO’s sDAI) could unlock $50B+ in lending revenue if U.S. interest bans lift.

- Enterprise Infrastructure

- Payments Networks: Shopify and Stripe integrations enable stablecoin settlements, reducing processing fees by 50-70%.

- Tokenized Treasury Products: BlackRock’s BUIDL fund ($1B+ inflows) demonstrates demand for blockchain-based yield instruments.

- Emerging Markets Penetration

- LatAm/SEA remittance corridors using USDT avoid 5-10% FX fees.

- Tether’s El Salvador HQ signals strategy to capture unbanked populations.

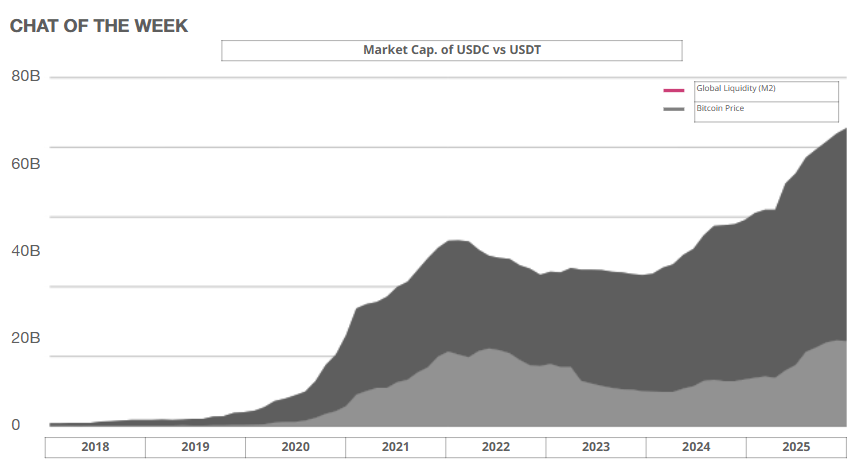

CHART OF THE WEEK

V. Market Leaders: Circle and Tether Case Studies

Circle:

- IPO Surge: Priced at $31/share (above $28 target), raising $880M. Revenue hit $1.7B in 2024 (100x growth since 2020) from USDC issuance fees and treasury yields.

- Regulatory Tailwinds: Genius Act passage could cement USDC as compliant standard, attracting institutional inflows.

Tether:

- Profit Dominance: $13B profit in 2024, tripling traditional finance giants, from Treasury yields ($7B), BTC/gold gains ($5B), and transaction fees.

- Vertical Integration: Investments in mining, AI, and telecom position it as a Web3 conglomerate.

- Reserve Strength: $7B+ excess reserves exceed Hong Kong’s capital requirements, enabling global expansion.

VII. Conclusion: The Path to Mainstream Adoption

Stablecoins are evolving into dual-nature assets: regulated monetary instruments and disruptive payment networks. The U.S. and Hong Kong models represent opposing visions—dollar hegemony versus market-led innovation—yet both validate the sector’s economic significance. For businesses, three opportunities stand out:

- Reserve Optimization: Yield-generating portfolios within regulatory guardrails.

- Embedded Finance: Integrating stablecoins into banking/payment stacks.

- Emerging Market Solutions: Leveraging speed/cost advantages for financial inclusion.

Circle’s IPO success and Tether’s profitability prove stablecoins are commercially viable beyond speculation. As regulation clarifies, issuers that master compliance while delivering programmable liquidity will capture the $1T+ opportunity at the intersection of traditional and digital finance. The next phase will hinge on harmonizing standards to enable global interoperability—transforming stablecoins from crypto utilities into core economic infrastructure.

DISCLAIMER

Chart of The Week: Sources: Bloomberg, Coindesk, Cointelegraph, Forbes, Rados.io, Linux Research

Market Cap & Trading Vol.: Sources: Coinmarketcap, Linux Research

Thought of The Week: Sources: AON, Bloomberg, Blockchain.com, CCN, Coindesk, Cointelegraph, Ethereum World News, Gemini, Insurance Journal, Los Angeles & San Francisco Daily Journal, Linux Research

Week Ahead: Sources: FxStreet.com, Linux Research

Weekly Recap: Sources: FxStreet.com, Linux Research

Past performance does not guarantee future results.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any cryptocurrencies. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

©Linux Group, October 2024.

Unless otherwise stated, all data is as of October 7, 2024 or as of most recently available.