WEEKLY RECAP

- U.S. Stocks: Rebounded in a holiday-shortened week (Nasdaq +2.01%), driven by Trump’s tariff delay and court ruling. Core PCE inflation eased to 2.5%, lowest since 2021, as consumer confidence rebounded.

- Europe: STOXX 600 +0.65% on EU trade talks. Slower inflation in France, Spain, Italy raises ECB rate-cut bets. Germany’s unemployment rose, UK services sentiment hit 2.5-year low.

- Japan: Nikkei +2.17% on U.S.-Japan trade hopes. 10-year JGB yield fell; Tokyo core CPI rose 3.6%, jobless rate steady at 2.5%.

- China: CSI 300 -1.08%, Shanghai Composite flat. China plans $70B for new infrastructure; manufacturing focus in 2026 Five-Year Plan under study.

- Others: Hungary held rates at 6.5% amid high inflation; S. Korea cut rates to 2.5% as growth slows, inflation stable at 2.1%.

WEEKLY AHEAD

- June 3, 2025, China National Bureau of Statistics, Caixin Manufacturing PMI

- June 5, 2025, United States Department of Commerce, Balance of Trade

- June 5, 2025, European Central Bank, ECB Main Refinancing Rate Decision

- June 8, 2025, Japan Ministry of Finance, GDP Growth Annualized Final QoQ

- June 9, 2025, China National Bureau of Statistics, Inflation Rate YoY

MAJOR MARKETS

Name

Dow Jones

S&P 500

Nasdaq

Nikkei 225

HSI

SHI

Last Close

42,270.07

5,911.69

19,113.77

37,965.10

23,289.77

3,347.49

7D%

1.58%

1.84%

1.97%

2.12%

-1.34%

-0.03%

THOUGHTS OF THE WEEK

Google (Alphabet Inc.) employs arguably the world’s most elite AI researchers, engineers, and technical visionaries, operating at the bleeding edge of quantum computing, autonomous systems, and foundational AI models. Its technological arsenal includes industry-leading TPU chips, the TensorFlow ecosystem, and vast proprietary datasets from Search, YouTube, and Android – advantages no startup or rival can fully replicate. Yet despite these formidable assets, Google faces an existential paradox: its core search empire, generating 57% of revenue and nearly all profits, is threatened by the very AI revolution it helped pioneer. The company’s future hinges not on technological capability, but on its willingness to disrupt itself.

The AI Talent Advantage: A Double-Edged Sword

Google’s talent density remains unmatched. From DeepMind’s AlphaFold breakthroughs to Gemini’s multimodal architecture, its labs consistently push scientific boundaries. This intellectual capital fuels vertical integration: custom AI chips (TPU v5) slash training costs, while proprietary data pipelines refine models with trillions of user interactions. However, talent alone cannot resolve Google’s core strategic conflict. Bureaucratic inertia, risk-averse product culture, and “responsible AI” constraints have slowed deployment. Gemini’s delayed releases and restrictive safeguards contrast sharply with OpenAI’s aggressive iteration – revealing how organizational friction can neutralize technical superiority.

Search’s Fragile Reign in the ChatGPT Era

Despite ChatGPT’s explosive growth, Google Search retains 89.7% market share through entrenched distribution (Chrome defaults, Android integration) and unmatched query understanding. Crucially, no competitor has replicated Google’s $200B search ad profit engine within conversational AI. However, cracks are emerging: high-intent verticals (e-commerce, healthcare) show 30–50% user migration to LLMs. Google’s response – embedding Gemini into Search via “AI Overviews” – risks accelerating revenue decline. Every AI-generated answer replaces 10 blue links and their associated ads, directly attacking its economic core.

The Cannibalization Trap: Innovation vs. Survival

Google’s dilemma epitomizes the Innovator’s Paradox: Disrupt search with superior AI, or protect the profit engine funding it? History reveals rare successes in such self-cannibalization: Tencent unleashed WeChat (2011) as an independent team to compete with its own QQ messaging cash cow, with founder Pony Ma accepting near-term revenue loss to capture mobile dominance. Similarly, Netflix’s Reed Hastings terminated DVD subscriptions (2011) at peak profitability ($600M/year) to force users onto streaming, betting everything on an unproven model. Both succeeded through founder-led radicalism – sacrificing immediate gains for existential reinvention. Google, however, lacks this decisive DNA. As a professionally managed corporation, Sundar Pichai faces institutionalized inertia: shareholders demand quarterly profit growth from search ads, while internal bureaucracies resist resource shifts from cash cows to speculative bets. Unlike Tencent/Netflix’s centralized, founder-driven pivots, Google’s consensus-driven structure cannot execute the necessary violence against its own business. Gemini thus remains shackled – deployed defensively within search to “enhance” rather than replace it, ensuring neither disruption nor salvation.

Why Google Fails Where Tencent/Netflix Succeeded

- Leadership Authority:

- Ma (Tencent) and Hastings (Netflix) were visionary founders with unchallenged power to stake their companies on existential bets.

- Pichai (Google) is a hired CEO accountable to risk-averse institutional investors and Alphabet’s complex governance.

- Organizational Structure:

- Tencent/Netflix created autonomous “startup” teams (WeChat/Streaming) physically and culturally isolated from legacy units.

- Gemini remains entangled with Google Search’s priorities, processes, and P&L constraints.

- Timing of Sacrifice:

- Netflix/Tencent attacked their cash cows at peak profitability (DVDs in 2011, QQ in 2011) to fund the future.

- Google delays radical action while search still grows, allowing disruption to advance unchallenged.

- Incentive Misalignment:

- 87% of Google’s revenue still flows from ads tied to traditional search. Executives compensated on short-term financial metrics rationally resist undermining it – a “Kodak Syndrome” Geoffrey Hinton called “inherently perverse.”

The brutal truth: Google’s talent and technology are rendered inert by a system designed to preserve the past. Without founder-level autonomy or a crisis forcing existential action, its cannibalization trap appears inescapable.

Key Takeaways

- Talent ≠ Strategy: Google’s technical brilliance is hamstrung by organizational caution and revenue-model conflicts.

- The Clock is Ticking: Search disruption is inevitable; early vertical migration proves user preference is shifting.

- Meta’s Lesson: Talent must be unleashed via radical resource reallocation – something Google has yet to demonstrate.

- Value Trap Dynamics: Low multiples signal permanent profit compression, not temporary weakness.

Google has the ability to build the best AI, but it is arguably the worst AI company.

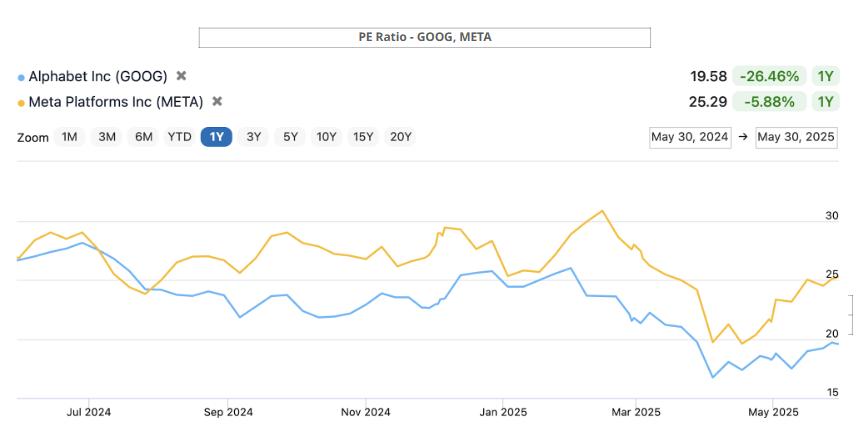

CHART OF THE WEEK

The Meta Contrast

This analysis gains urgency when contrasting Google with Meta. While both faced core business threats (Google: AI search disruption, Meta: TikTok + iOS privacy) Meta executed a decisive, aggressive pivot – slashing costs, refocusing on AI-driven advertising efficiency, and investing heavily in foundational AI infrastructure despite near-term profit pain.

Meta’s resurgence underscores a brutal leadership truth: in existential moments, the willingness to inflict near-fatal pain determines survival.

- Laying off 21,000 employees (23% of workforce) despite $32B cash reserves,

- Killing non-core projects (NFTs, Portal hardware) to conserve $16B/year,

- Redirecting 80% of tech talent to AI infrastructure, betting the company on LLMs.

Meta (Zuckerberg)

Founder-CEO with 58% voting control

Centralized “rule by force” execution

Embraced 2022–23 stock collapse (-76%) as necessary sacrifice

Publicly declared 2023 “Year of Efficiency”

Google (Pichai)

Professional CEO accountable to Alphabet board

Distributed fiefdoms (Search, YouTube, Cloud) competing for resources

Avoids radical cuts while Search still grows 10% annually

Announced “simplicity sprint” (2022) with no material restructuring

DISCLAIMER

Chart of The Week: Sources: Bloomberg, Coindesk, Cointelegraph, Forbes, Rados.io, Linux Research

Market Cap & Trading Vol.: Sources: Coinmarketcap, Linux Research

Thought of The Week: Sources: AON, Bloomberg, Blockchain.com, CCN, Coindesk, Cointelegraph, Ethereum World News, Gemini, Insurance Journal, Los Angeles & San Francisco Daily Journal, Linux Research

Week Ahead: Sources: FxStreet.com, Linux Research

Weekly Recap: Sources: FxStreet.com, Linux Research

Past performance does not guarantee future results.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any cryptocurrencies. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

©Linux Group, October 2024.

Unless otherwise stated, all data is as of October 7, 2024 or as of most recently available.