WEEKLY RECAP

- Global equities soar: S&P 500 (+5%), Nasdaq (+5%) hit records; Europe, Japan rise on trade deals, Middle East calm.

- Inflation trends: US core PCE at 2.7% YoY; consumer expectations drop to 5%. Eurozone/ Japan inflation ticks up.

- Central banks cautious: Fed hints at rate cuts; BoE sees “gradual” easing; BoJ stays cautious on policy.

- Mixed economic data: US durable goods surge, housing weakens. Eurozone PMI stagnates; German confidence up.

- Trade & EM updates: US-China deal lifts Chinese stocks. Mexico cuts rates to 8%; Brazil raises 2025 GDP outlook.

WEEKLY AHEAD

- July 1, 2025, China, Caixin Manufacturing PMI (June)

- July 1, 2025, USA, ISM Manufacturing PMI (June)

- July 5, 2025, USA, Nonfarm Payrolls & Unemployment Rate (June)

- July 5, 2025, USA, ISM Non-Manufacturing PMI (June)

- July 1, 2025, Japan, Tankan Large Manufacturers Index (Q2)

MAJOR MARKETS

Name

Dow Jones

S&P 500

Nasdaq

Nikkei 225

HSI

SHI

Last Close

43,819.27

6,173.07

20,273.46

40,150.79

24,284.15

3,424.23

7D%

3.82%

3.44%

4.25%

4.55%

3.20%

1.91%

THOUGHTS OF THE WEEK

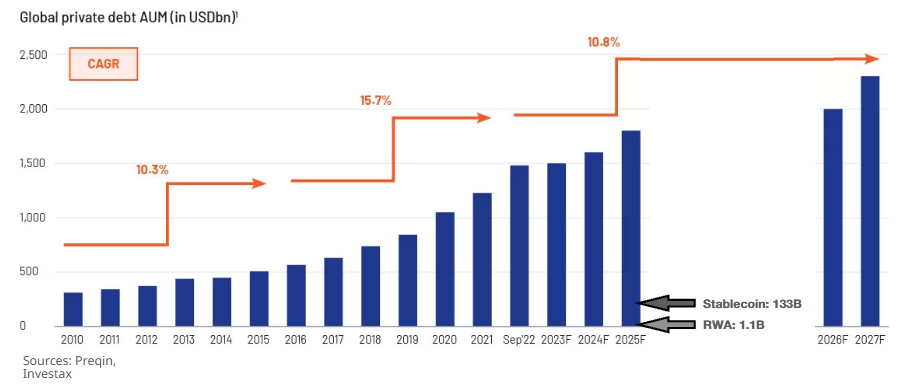

Private credit has emerged as a $1.7 trillion powerhouse, filling the void left by traditional banks after post-2008 regulations constrained lending. This asset class thrives on flexibility and customization, offering tailored solutions for middle-market borrowers ($15M-$75M EBITDA), sponsor-backed buyouts, and specialized sectors like asset-based finance. Unlike public markets, private credit operates through bilateral agreements with features like payment-in-kind (PIK) options and unitranche structures, enabling faster execution and covenant flexibility. However, this customization creates fragmentation and illiquidity: loans are typically held to maturity (5-7 years), lack standardized identifiers, and have minimal secondary markets. With $450 billion in dry powder—including $150 billion for distressed debt—private credit is poised to expand further, intensifying liquidity challenges.

I. Tokenization: Bridging Real-World Assets and Liquidity

Tokenization is transforming private credit’s structural limitations by converting loans into tradable digital tokens on blockchains. Key advancements include:

- Market Explosion: Tokenized RWAs surged to $24 billion in 2025, with private credit dominating ($14 billion, 58% of the total)

- Enhanced Liquidity: Fractional ownership allows investors to trade tokenized loans on secondary markets, mitigating the “buy-and-hold” constraint. Ethereum leads with $7.5 billion in tokenized assets, while Solana and Avalanche gain traction for high-throughput use cases.

- Transparency and Efficiency: Blockchain’s immutable ledger automates interest distributions and loan compliance via smart contracts, reducing administrative costs by 30-50%. For example, Hamilton Lane tokenized its $650 million Senior Credit Opportunities fund on Ethereum, enabling smaller investors to access institutional-grade private credit.

II. Use Case: SME Lending Platform with Instant Liquidity

Scenario: A solar equipment manufacturer seeks $50 million to expand operations but faces traditional banking delays.

Tokenization & DeFi Workflow:

- Loan Origination: A private credit fund (e.g., Churchill) underwrites and issues the loan as 50 million ERC-1404 tokens ($1 each) on Ethereum.

- Collateralization: The manufacturer deposits tokens into a permissioned DeFi pool (e.g., Aave Horizon).

- Liquidity Access:

- The fund retains 30 million tokens for long-term yield.

- 20 million tokens are listed on a secondary market.

- Token holders borrow stablecoins against their RWA collateral at 70% LTV, using funds for operational needs 472.

- Value Created:

- Borrower: Receives capital in days vs. months.

- Investors: Gain exposure to institutional-grade credit with fractional ownership and exit options.

- Funds: Earn fees from token trading and DeFi integrations while retaining loan servicing rights.

III. DeFi Integration: Programmable Yield and Collateral Innovation

DeFi protocols unlock novel utility for tokenized private credit:

- Collateralization: Tokenized loans serve as collateral for borrowing stablecoins on platforms like Centrifuge and MakerDAO’s Sky protocol. Centrifuge’s $289 million active loan portfolio uses consumer ABS and real estate bridging loans as collateral, with senior tranches funding 70% of asset value.

- Yield Enhancement: Apollo’s ACRED fund integrates with DeFi protocols (Morpho, Kamino) to offer 8-12% yields. Investors engage in “RWA looping,” using tokenized credit in leveraged yield strategies.

Hybrid Capital Models: Blended finance structures emerge: TradFi institutions fund senior tranches (70-85%), while DeFi lenders absorb first-loss risk via junior tranches (15-30%). Kasu and Centrifuge exemplify this convergence, aligning due diligence rigor with decentralized capital efficiency.

IV. Challenges and the Path Forward

Despite progress, critical hurdles persist:

- Regulatory Uncertainty: Tokenized credit straddles securities, commodities, and loan regulations. Switzerland and Luxembourg lead in clarity, but U.S. fragmentation slows adoption.

- Oracle Reliability: RWA valuations require NAV-based oracles (e.g., RedStone), which blend audited off-chain data with on-chain execution. Mismatches between real-time trading and quarterly appraisals create settlement risks.

- Interoperability: Isolated blockchain ecosystems (Ethereum vs. Solana vs. Canton Network) hinder cross-chain trading. Plume’s multi-chain RWA infrastructure aims to resolve this.

Solutions in Development:

- Permissioned DeFi: Platforms like Libre and Securitize embed KYC/AML into smart contracts.

- Legal Wrappers: SPVs anchor tokenized loans to enforce jurisdiction-specific rights.

- Institutional-Grade Oracles: Hybrid systems combine traditional audits with zero-knowledge proofs for privacy.

V. Conclusion: The Hybrid Finance Future

Private credit’s evolution, from niche lending to a tokenized, DeFi-integrated asset class-signals a broader capital markets transformation. Tokenization solves illiquidity while DeFi enables programmable yield, creating a $3.5 trillion opportunity by 2028. Success hinges on reconciling TradFi’s regulatory rigor with DeFi’s innovation: expect growth in risk-tranching protocols, DAO-led underwriting, and real-time on-chain data rooms. As Apollo, KKR, and BlackRock expand tokenized offerings, the fusion of blockchain efficiency with credit fundamentals will redefine debt markets, making them more accessible, liquid, and resilient amid geopolitical and economic volatility.

CHART OF THE WEEK

Private Credit Transformation: Tokenization Bridges Liquidity & YieldDeFi collateralization boosts yields by 15–25%.

A "Sweet Spot" for RWA Tokenization

- Stable Cash Flows: Fixed repayment schedules from secured loans, less volatile than real estate/infrastructure or commodities/equities.

- Higher Yields: 6–15% annual returns (vs. DeFi Lending Protocol <3%), with risk managed via collateral and pooling (e.g., CLOs).

- Liquidity via Tokenization: Fractionalizing loans enables DeFi trading, yielding 15–25% more than traditional private credit (vs. real estate’s legal hurdles or private equity’s complexity).

- Massive Market Size: $1.7T AUM with $450B dry powder, scalable vs. niche RWAs like art/collectibles.

- DeFi-Friendly Collateral: Fungible, transparently valued, and uncorrelated to crypto (vs. renewable energy’s long-term cash flows).

- Regulatory Ease: Loan contracts fit existing securities laws, simpler than cross-border real estate tokenization.

- Diversification Flexibility: Pooled across sectors/regions, reducing single-asset risk (vs. standalone real estate).

DISCLAIMER

Chart of The Week: Sources: Bloomberg, Coindesk, Cointelegraph, Forbes, Rados.io, Linux Research

Market Cap & Trading Vol.: Sources: Coinmarketcap, Linux Research

Thought of The Week: Sources: AON, Bloomberg, Blockchain.com, CCN, Coindesk, Cointelegraph, Ethereum World News, Gemini, Insurance Journal, Los Angeles & San Francisco Daily Journal, Linux Research

Week Ahead: Sources: FxStreet.com, Linux Research

Weekly Recap: Sources: FxStreet.com, Linux Research

Past performance does not guarantee future results.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any cryptocurrencies. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

©Linux Group, October 2024.

Unless otherwise stated, all data is as of October 7, 2024 or as of most recently available.