WEEKLY RECAP

- Global Markets Brace as Fed Holds Rates Amid Mixed

Economic Signals - China’s Yuan Strengthens Amid Trade Recovery and

Monetary Easing Hints - Asia Central Banks Cut Rates to Support Growth Amid

Global Uncertainties - Oil Prices Slide and Bitcoin Stabilizes in Volatile Market

Week

MAJOR MARKETS

Name

Dow Jones

S&P 500

Nasdaq

Nikkei 225

HSI

SHI

Last Close

41,249.38

5,679.00

17,928.92

37,644.26

22,867.00

3,342.00

7D%

-0.16%

-0.14%

-0.27%

2.16%

1.58%

1.89%

WEEKLY AHEAD

- May 14, 2025, U.S. Census Bureau, Retail Sales

- May 14, 2025, U.S. Federal Reserve, Industrial

Production & Capacity Utilization - May 15, 2025, Japan Cabinet Office, GDP Growth Rate

(Preliminary) - May 16, 2025, Japan Ministry of Economy, Trade and

Industry, Industrial Production (Final) - May 19, 2025, China National Bureau of Statistics,

Retail Sales - May 19, 2025, China National Bureau of Statistics, GDP

Growth Rate Q1 2025 - May 19, 2025, China National Bureau of Statistics,

Industrial Production

THOUGHTS OF THE WEEK

As markets oscillate between cautious optimism and acute anxiety, investors face a critical juncture defined by three overlapping forces: escalating U.S.-China trade

brinkmanship, a bifurcating AI landscape, and the precariousness of short-term market euphoria. Here’s our framework for navigating these crosscurrents.

The U.S.-China Tariff Gambit: A High-Stakes Game of Chicken

The latest headlines around potential tariff cuts (from 145% to ~50-54% on select goods) suggest both sides are testing the waters for a tactical détente. While the Biden administration seeks to alleviate inflationary pressures and stabilize supply chains, China’s demand for unilateral tariff removals underscores its refusal to concede perceived asymmetrical demands. However, Trump’s recent tweet—hinting at retaining 80% tariffs—serves as a stark reminder of the fragility of these negotiations.

Implications:

- Sectoral Winners/Losers: Retail, consumer goods, and industrials remain hypersensitive to tariff outcomes. Companies like Basic Fun (toys) and Home Depot (import-heavy retailers) are already recalibrating supply chains, but a partial tariff rollback could offer near-term relief.

- Market Volatility: Expect heightened volatility in trade-exposed equities (e.g., semiconductors, EVs) as headlines dominate. Options strategies (e.g., straddles on SPY or FXI) may hedge against binary outcomes.

- Long-Term Reality Check: Even if tariffs ease, structural decoupling in tech(e.g., semiconductor restrictions) and energy (rare earths) will persist.Diversification into ASEAN manufacturing hubs (Vietnam, India) remains prudent.

Lyft: A Case Study in Short-Term Euphoria vs. Structural Challenges

Lyft’s recent 65% stock surge—driven by a modest earnings beat and a $2.5B buyback announcement—offers a textbook example of tactical optimism clashing with long-term risks. Here’s our breakdown:

The Bull Case

- Buyback Boost: The expanded repurchase program (25% of market cap) artificially inflates EPS, appealing to momentum traders.

- Cost Discipline: Adjusted EBITDA margins hit 12%, up from 4% in 2024Q1,driven by reduced driver incentives and route optimization.

- AV Hype: Autonomous vehicle partnerships (e.g., Motional) position Lyft as a potential disruptor in the $8T mobility-as-a-service market.

The Bear Case

- Unit Economics Decay: Driver incentive costs rose 9% QoQ despite cuts, signaling labor market tightness.

- Market Share Erosion: Lyft’s U.S. ride-hailing share fell to 28% (vs. Uber’s 72%), with no clear path to reverse the trend.

- Buyback Misdirection: Repurchases mask stagnant revenue growth (2% YoY vs. Uber’s 14%) and divert capital from R&D (down 15% YoY).

Wall Street’s Warning: The Recession Risk Markets Are Ignoring

Goldman Sachs and Bank of America’s bearish forecasts—flagging a potential 20% S&P 500 correction—are not mere noise. Their arguments hinge on three pillars:

The Bull Case

- Earnings Mirage: Q1 earnings strength reflects pre-tariff realities. Margins face compression from wage inflation, rising input costs, and slowing consumer demand.

- Valuation Hubris: The S&P 500’s forward P/E of 21x assumes a “soft landing” that even the Fed questions. A recessionary rerating (to 16-18x) would align with historical norms.

- Global Rotation: Non-U.S. equities (Europe, Japan) now trade at a 35% discount to U.S. peers—a gap too wide to ignore as USD strength wanes.

Action: Trim exposure to richly valued megacaps (AAPL, NVDA) and rebalance toward defensive sectors (utilities, healthcare) and international ETFs (EWJ, EZU).

AI’s Great Divergence: Winners, Losers, and the Infrastructure Play

AI remains 2025’s most compelling thematic, but its trajectory is fracturing. Microsoft (+41% YTD) and Palantir (+55%) thrive on enterprise adoption and government contracts, while chipmakers (NVDA, TSM) languish under geopolitical overhangs.

Two trends stand out:

- Vertical Dominance: Firms embedding AI into mission-critical workflows (e.g., CrowdStrike in cybersecurity, GE Vernova in energy grid optimization) are outperforming horizontal “AI-as-a-service” players.

- The Compute Arms Race: With Microsoft alone earmarking $80B for data centers, infrastructure enablers (power utilities, cooling systems) are emerging as stealth beneficiaries. NextEra Energy (up 18% YTD) exemplifies this shift.

Takeaway: Focus on AI infrastructure (data centers, energy suppliers) and vertical specialists with pricing power. Avoid commoditized hardware plays vulnerable to export controls.

Actionable Insights

The coming quarter will reward those who treat uncertainty as a design constraint, not a disruption. Agility begins with structural preparedness.

- Reallocate 5-10% of equity portfolios to energy transition infrastructure (liquefied natural gas terminals, grid modernization).

- Implement dynamic tariff hedging using currency baskets weighted to ASEAN production hubs.

- Accelerate cross-border entity setup in Singapore/Vietnam to preempt Q3 tariff escalations.

CHAT OF THE WEEK

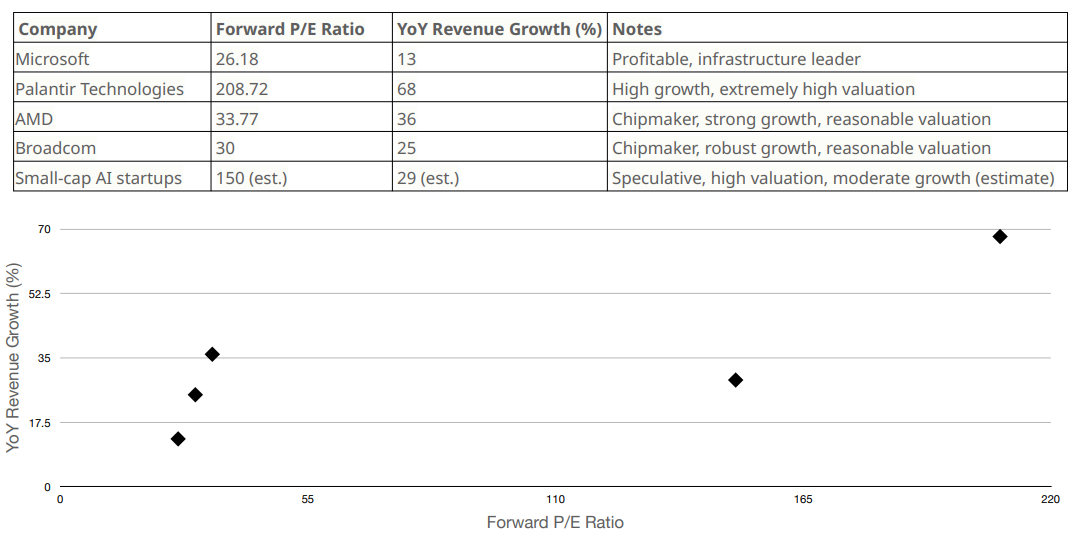

The 2025 AI equity landscape is marked by a sharp divergence: profitable infrastructure companies (chipmakers, cloud providers) offer strong growth at reasonable valuations, while pure-play AI software names attract speculative premiums, exposing investors to greater risk if growth expectations falter. This dynamic underscores the importance of distinguishing between sustainable, profit-driven growth and momentum-driven hype in the AI sector.

- High Growth + High Valuation:

Palantir stands out with both the highest YoY revenue growth (68%) and the highest forward P/E ratio (208.72), reflecting intense investor enthusiasm for its AI-driven analytics platform. Microsoft also delivers strong growth (13%) but at a much more reasonable valuation (26.18), highlighting its status as a mature, profitable infrastructure provider. - High Growth + Depressed Valuation:

AMD and Broadcom, both chipmakers, show robust double-digit growth (36% and 25% respectively) but trade at modest forward P/E ratios (33.77 and ~30), indicating that the market values their profitability and infrastructure role but does not assign them the same speculative premium as pure AI software plays. - Low Growth + Speculative Valuation:

Small-cap AI startups are estimated to have moderate growth (29%) but trade at very high forward P/E ratios (~150), suggesting overhyped expectations despite unproven profitability.

DISCLAIMER

Chart of The Week: Sources: Bloomberg, Coindesk, Cointelegraph, Forbes, Rados.io, Linux Research

Market Cap & Trading Vol.: Sources: Coinmarketcap, Linux Research

The horizontal axis represents the week number in 2018. For instance, W21 indicates the twenty first week in 2018. The primary vertical axis represents total market capitalization; and the secondary vertical axis represents total trading volume.

Thought of The Week: Sources: AON, Bloomberg, Blockchain.com, CCN, Coindesk, Cointelegraph, Ethereum World News, Gemini, Insurance Journal, Los Angeles & San Francisco Daily Journal, Linux Research

Week Ahead: Sources: FxStreet.com, Linux Research

Weekly Recap: Sources: FxStreet.com, Linux Research

Past performance does not guarantee future results.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but

do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any cryptocurrencies. The views and strategies described may not be suitable for all investors. This material has been

prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or

interpreted as a recommendation.

©Linux Group, October 2024.

Unless otherwise stated, all data is as of October 7, 2024 or as of most recently available.