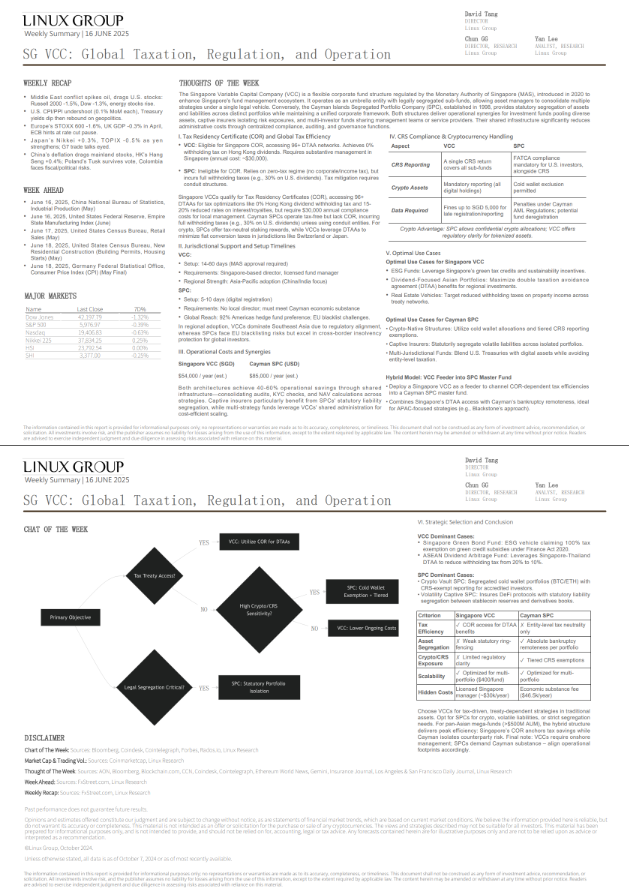

The Singapore Variable Capital Company (VCC) is a flexible corporate fund structure regulated by the Monetary Authority of Singapore (MAS), introduced in 2020toenhance Singapore’s fund management ecosystem. It operates as an umbrella entity with legally segregated sub-funds, allowing asset managers to consolidate multiplestrategies under a single legal vehicle. Conversely, the Cayman Islands Segregated Portfolio Company (SPC), established in 1998, provides statutory segregation of assetsand liabilities across distinct portfolios while maintaining a unified corporate framework. Both structures deliver operational synergies for investment funds pooling diverseassets, captive insurers isolating risk exposures, and multi-investor funds sharing management teams or service providers. Their shared infrastructure significantly reducesadministrative costs through centralized compliance, auditing, and governance functions.

To get the full report, please contact us at [email protected]