WEEKLY RECAP

- June 16, 2025, China National Bureau of Statistics, Industrial Production (May)

- June 16, 2025, United States Federal Reserve, Empire State Manufacturing Index (June)

- June 17, 2025, United States Census Bureau, Retail Sales (May)

- June 18, 2025, United States Census Bureau, New Residential Construction (Building Permits, Housing Starts) (May)

- June 18, 2025, Germany Federal Statistical Office, Consumer Price Index (CPI) (May Final)

WEEKLY AHEAD

- Middle East conflict spikes oil, drags U.S. stocks: Russell 2000 -1.5%, Dow -1.3%, energy stocks rise.

- U.S. CPI/PPI undershoot (0.1% MoM each), Treasury yields dip then rebound on geopolitics.

- Europe’s STOXX 600 -1.6%, UK GDP -0.3% in April, ECB hints at rate cut pause.

- Japan’s Nikkei +0.3%, TOPIX -0.5% as yen strengthens; G7 trade talks eyed.

- China’s deflation drags mainland stocks, HK’s Hang Seng +0.4%; Poland’s Tusk survives vote, Colombia faces fiscal/political risks.

MAJOR MARKETS

Name

Dow Jones

S&P 500

Nasdaq

Nikkei 225

HSI

SHI

Last Close

42,197.79

5,976.97

19,406.83

37,834.25

23,792.54

3,377.00

7D%

-1.32%

-0.39%

-0.63%

0.25%

0.00%

-0.25%

THOUGHTS OF THE WEEK

The Singapore Variable Capital Company (VCC) is a flexible corporate fund structure regulated by the Monetary Authority of Singapore (MAS), introduced in 2020 to enhance Singapore’s fund management ecosystem. It operates as an umbrella entity with legally segregated sub-funds, allowing asset managers to consolidate multiple strategies under a single legal vehicle. Conversely, the Cayman Islands Segregated Portfolio Company (SPC), established in 1998, provides statutory segregation of assets and liabilities across distinct portfolios while maintaining a unified corporate framework. Both structures deliver operational synergies for investment funds pooling diverse assets, captive insurers isolating risk exposures, and multi-investor funds sharing management teams or service providers. Their shared infrastructure significantly reduces administrative costs through centralized compliance, auditing, and governance functions.

I. Tax Residency Certificate (COR) and Global Tax Efficiency

- VCC: Eligible for Singapore COR, accessing 96+ DTAA networks. Achieves 0% withholding tax on Hong Kong dividends. Requires substantive management in Singapore (annual cost: ~$30,000).

- SPC: Ineligible for COR. Relies on zero-tax regime (no corporate/income tax), but incurs full withholding taxes (e.g., 30% on U.S. dividends). Tax mitigation requires conduit structures.

Singapore VCCs qualify for Tax Residency Certificates (COR), accessing 96+ DTAAs for tax optimizations like 0% Hong Kong dividend withholding tax and 15-20% reduced rates on interest/royalties, but require $30,000 annual compliance costs for local management. Cayman SPCs operate tax-free but lack COR, incurring full withholding taxes (e.g., 30% on U.S. dividends) unless using conduit entities. For crypto, SPCs offer tax-neutral staking rewards, while VCCs leverage DTAAs to minimize fiat conversion taxes in jurisdictions like Switzerland or Japan.

II. Jurisdictional Support and Setup Timelines

VCC:

- Setup: 14-60 days (MAS approval required)

- Requirements: Singapore-based director, licensed fund manager

- Regional Strength: Asia-Pacific adoption (China/India focus)

SPC:

- Setup: 5-10 days (digital registration)

- Requirements: No local director; must meet Cayman economic substance

- Global Reach: 92% Americas hedge fund preference; EU blacklist challenges.

In regional adoption, VCCs dominate Southeast Asia due to regulatory alignment, whereas SPCs face EU blacklisting risks but excel in cross-border insolvency protection for global investors.

III. Operational Costs and Synergies

Singapore VCC (SGD)

Cayman SPC (USD)

$54,000 / year (est.)

$85,000 / year (est.)

Both architectures achieve 40-60% operational savings through shared infrastructure—consolidating audits, KYC checks, and NAV calculations across strategies. Captive insurers particularly benefit from SPCs’ statutory liability segregation, while multi-strategy funds leverage VCCs’ shared administration for cost-efficient scaling.

IV. CRS Compliance & Cryptocurrency Handling

Aspect

CRS Reporting

Crypto Assets

Data Required

VCC

A single CRS return covers all sub-funds

Mandatory reporting (all digital holdings)

Fines up to SGD 5,000 for late registration/reporting

SPC

FATCA compliance mandatory for U.S. investors, alongside CRS

Cold wallet exclusion permitted

Penalties under Cayman AML Regulations; potential fund deregistration

Crypto Advantage: SPC allows confidential crypto allocations; VCC offers regulatory clarity for tokenized assets.

V. Optimal Use Cases

Optimal Use Cases for Singapore VCC

- ESG Funds: Leverage Singapore’s green tax credits and sustainability incentives.

- Dividend-Focused Asian Portfolios: Maximize double taxation avoidance agreement (DTAA) benefits for regional investments.

- Real Estate Vehicles: Target reduced withholding taxes on property income across treaty networks.

Optimal Use Cases for Cayman SPC

- Crypto-Native Structures: Utilize cold wallet allocations and tiered CRS reporting exemptions.

- Captive Insurers: Statutorily segregate volatile liabilities across isolated portfolios.

- Multi-Jurisdictional Funds: Blend U.S. Treasuries with digital assets while avoiding entity-level taxation.

Hybrid Model: VCC Feeder into SPC Master Fund

- Deploy a Singapore VCC as a feeder to channel COR-dependent tax efficiencies into a Cayman SPC master fund.

- Combines Singapore’s DTAA access with Cayman’s bankruptcy remoteness, ideal for APAC-focused strategies (e.g., Blackstone’s approach).

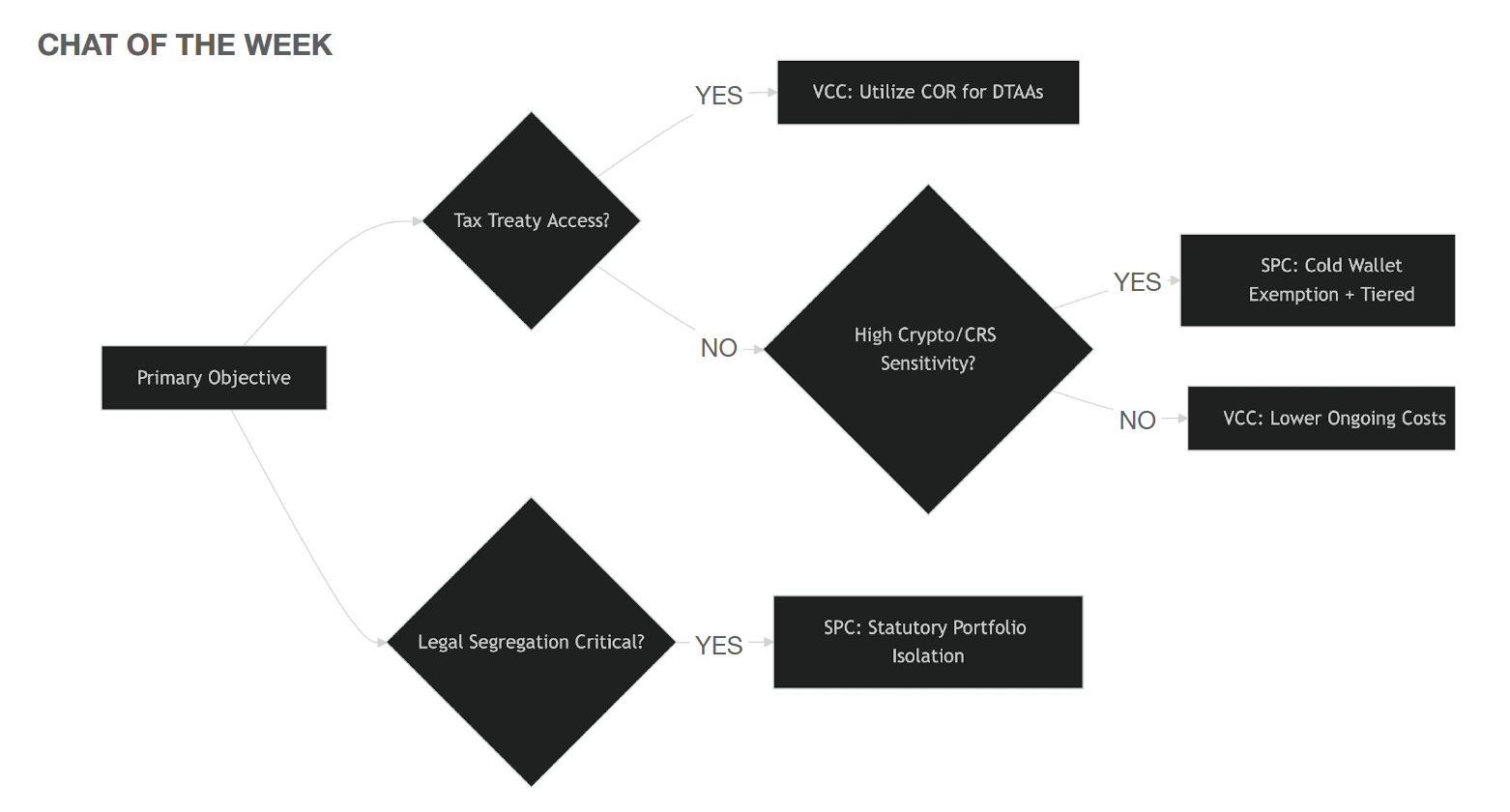

CHART OF THE WEEK

VI. Strategic Selection and Conclusion

VCC Dominant Cases:

- Singapore Green Bond Fund: ESG vehicle claiming 100% tax exemption on green credit subsidies under Finance Act 2020.

- ASEAN Dividend Arbitrage Fund: Leverages Singapore-Thailand DTAA to reduce withholding tax from 20% to 10%.

SPC Dominant Cases:

- Crypto Vault SPC: Segregated cold wallet portfolios (BTC/ETH) with CRS-exempt reporting for accredited investors.

- Volatility Captive SPC: Insures DeFi protocols with statutory liability segregation between stablecoin reserves and derivatives books.

IV. CRS Compliance & Cryptocurrency Handling

Criterion

Tax Efficiency

Asset Segregation

Crypto/CRS Exposure

Scalability

Hidden Costs

VCC

✓ COR access for DTAA benefits

✗ Weak statutory ring-fencing

✗ Limited regulatory clarity

✓ Optimized for multi-portfolio ($400/fund)

Licensed Singapore manager (~$30k/year)

SPC

✗ Entity-level tax neutrality only

✓ Absolute bankruptcy remoteness per portfolio

✓ Tiered CRS exemptions

✓ Optimized for multi-portfolio

Economic substance fee ($46.5k/year)

Choose VCCs for tax-driven, treaty-dependent strategies in traditional assets. Opt for SPCs for crypto, volatile liabilities, or strict segregation needs. For pan-Asian mega-funds (>$500M AUM), the hybrid structure delivers peak efficiency: Singapore’s COR anchors tax savings while Cayman isolates counterparty risk. Final note: VCCs require onshore management; SPCs demand Cayman substance – align operational footprints accordingly.

DISCLAIMER

Chart of The Week: Sources: Bloomberg, Coindesk, Cointelegraph, Forbes, Rados.io, Linux Research

Market Cap & Trading Vol.: Sources: Coinmarketcap, Linux Research

Thought of The Week: Sources: AON, Bloomberg, Blockchain.com, CCN, Coindesk, Cointelegraph, Ethereum World News, Gemini, Insurance Journal, Los Angeles & San Francisco Daily Journal, Linux Research

Week Ahead: Sources: FxStreet.com, Linux Research

Weekly Recap: Sources: FxStreet.com, Linux Research

Past performance does not guarantee future results.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any cryptocurrencies. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

©Linux Group, October 2024.

Unless otherwise stated, all data is as of October 7, 2024 or as of most recently available.