WEEKLY RECAP

- U.S. Stock Surge: Major indexes hit record highs due to favorable trade deals with Japan and progress with the EU.

- Mixed Earnings: Alphabet’s stock rose on strong AI results, while Tesla’s disappointing report led to a decline.

- Economic Growth: U.S. services sector growth outpaced manufacturing, raising sustainability concerns.

- Housing Market Struggles: Existing home sales fell 2.7% amid high mortgage rates, with prices reaching record highs.

- Global Outlook: The ECB held rates steady amid trade uncertainties, while Japan’s market rose after a positive U.S. trade agreement.

WEEKLY AHEAD

- July 28, 2025, USA Bureau of Economic Analysis, Gross Domestic Product (GDP) (Q2 2025 )

- July 29, 2025, China National Bureau of Statistics, Caixin Manufacturing PMI (July)

- July 30, 2025, USA Bureau of Labor Statistics, Employment Situation (July)

- July 31, 2025, China National Bureau of Statistics, Non-Manufacturing PMI (July)

- August 1, 2025, USA Institute for Supply Management (ISM), Manufacturing PMI (July)

MAJOR MARKETS

Name

Dow Jones

S&P 500

Nasdaq

Nikkei 225

HSI

SHI

Last Close

44,901.92

6,388.64

21,108.32

41,456.23

25,388.35

3,593.66

7D%

1.20%

2.06%

2.54%

4.77%

5.17%

2.38%

THOUGHTS OF THE WEEK

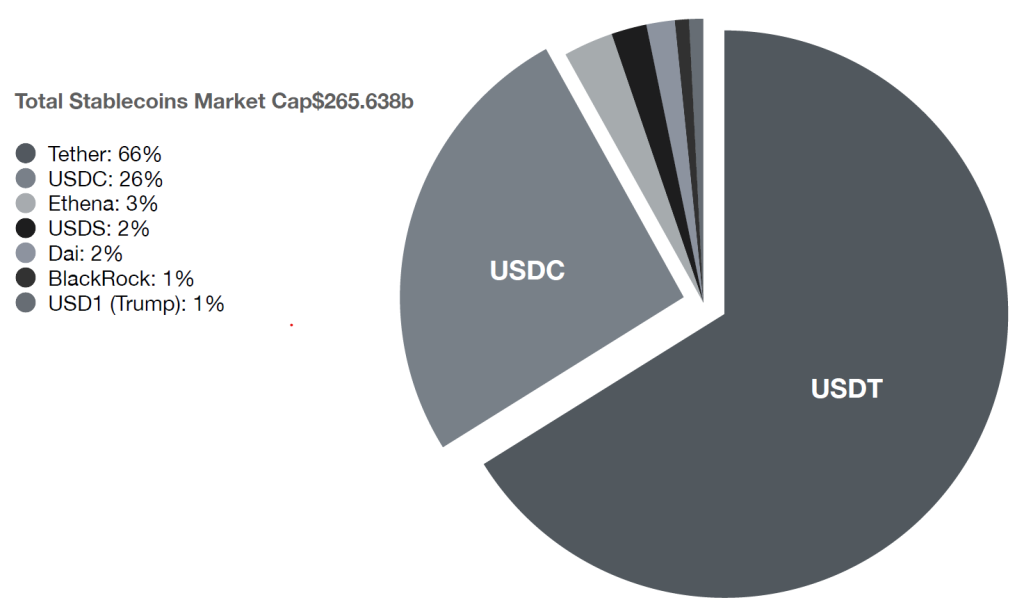

Stablecoins represent a profound contradiction at the heart of cryptocurrency’s evolution. Born from blockchain’s promise of decentralization, they now dominate a $160 billion market by embracing *centralized control* – a necessary compromise to achieve price stability. This tension has ignited a geopolitical arms race, with the U.S. passing its Stablecoin Bill, Hong Kong enacting the Stablecoin Ordinance (effective August 1, 2024), and institutions like Circle leveraging regulatory clarity for a 750% IPO surge. As Trump’s USD1 coin draws $20 billion from Abu Dhabi and emerging markets like Argentina adopt stablecoins for survival, these digital tokens reveal how engineered stability reshapes global power structures.

I. Origins: Solving Crypto’s Volatility Problem

The quest for stability began decades before Bitcoin. In the 1990s, DigiCash’s centralized digital currency failed due to distrust in intermediaries. The 2013 Bitcoin crash – which erased 80% of value in 48 hours – became the catalyst for modern stablecoins. Tether (launched as “Realcoin” in 2014) emerged as a dollar proxy, allowing traders to hedge volatility without exiting blockchain ecosystems.

By 2024, stablecoins processed $27.6 trillion in transactions – surpassing Visa and Mastercard combined – while becoming economic lifelines in hyperinflation economies. In Argentina and Nigeria, citizens now use USDT to pay rent and bypass currency controls, demonstrating real-world utility that transcends speculative trading.

II. Ghost of TCJA Past: The Buyback Boom Revisited

Stablecoins engineer “peg reliability” through distinct – and often fragile – mechanisms. Fiat-backed models like USDT and USDC hold 1:1 dollar reserves but face centralization risks, as seen in Tether’s $130 billion profits with just 100 employees. Crypto-collateralized systems (e.g., DAI) demand 150%+ asset backing but remain vulnerable to liquidation spirals and ironic dependencies on centralized assets like USDC. Algorithmic stablecoins such as Terra’s UST collapsed in 2022 due to reflexive supply algorithms, while synthetic delta-hedged coins like Ethena’s USDe pioneer a hybrid approach: they generate yield by staking Ethereum and shorting perpetual futures on centralized exchanges (CEXs), yet introduce CEX counterparty risk.

Type

Fiat-Backed

Crypto-Collateralized

Algorithmic

Synthetic Delta-Hedged

Mechanism

1:1 USD reserves (USDT, USDC)

150%+ ETH collateral (DAI, LUSD)

Supply algorithms (UST)

Derivative hedging (USDe)

Weaknesses

Centralization, audit risks

Liquidation spirals, USDC dependency

Death spirals (Terra collapse)

CEX dependency, basis risk

III. Key Tension: The Impossible Trinity

Stablecoin

USDT/USDC

DAI

UST

USDe

Mechanism

Stability + Efficiency

Stability + Decentralized

Efficiency + Decentralized

Stability + Efficiency

Weaknesses

Centralized control

Capital-inefficient

Unstable (death spiral)

Centralized hedging dependencies.

IV. The Great Decentralization Retreat

The crypto industry is quietly surrendering decentralization to pragmatic and regulatory pressures. DAI’s growing reliance on USDC collateral (>60%) mirrors DeFi’s dependence on TradFi assets. Ethena’s USDe openly depends on CEXs for futures hedging – a vulnerability exposed if exchanges like Bybit or Binance fail. Regulatory frameworks accelerate this shift: the EU’s MiCA bans algorithmic stablecoins entirely, while the U.S. Stablecoin Bill mandates 100% reserves and audits, privileging entities like Circle. Hong Kong’s sandbox licenses for JD Coin and ANT Group further embed institutional control. As Circle CEO Jeremy Allaire noted, “Compliance is the gateway to mass adoption” – a reality placing 93% of stablecoin value under centralized governance.

Centralization Domination

Regulatory Capture

Systemic Risks

Fiat-backed stablecoins (USDT, USDC) control 95% of the market

“Decentralized” projects (DAI, USDe) rely on centralized components

Laws favor entities with compliance infrastructure (Payment companies, Banks)

Offshore issuers (e.g., Tether) face exclusion from U.S. market

CEX dependency creates single points of failure (e.g., Ethena’s hedging model)

DeFi’s stability tied to TradFi reserves (USDC collateral in DAI)

CHAT OF THE WEEK

V. What’s Next: Hybrids vs. State Power

Three converging battles will define stablecoins’ future:

- Synthetic 2.0 vs. Tokenized RWAs: Projects like Ethena aim to mitigate CEX risk through cross-exchange hedging, while TradFi giants tokenize real-world assets. BlackRock’s BUIDL fund ($29B) merges Treasury yields with blockchain efficiency, and ANT Group pilots tokenized solar farms in Hong Kong’s sandbox.

- Geopolitical Weaponization: The U.S. promotes dollar-backed stablecoins to counter de-dollarization—Tether alone bought $331B in U.S. Treasuries in 2024. Concurrently, Hong Kong’s “Cross-Border Payment Connect” with China tests offshore RMB stablecoins, expanding monetary influence.

- Regulatory Fragmentation: MiCA’s interest payment ban clashes with Singapore’s innovation-friendly stance. The U.S. bill may exclude offshore issuers like Tether, forcing consolidation under compliant players like Circle.

VI. Next: Stablecoins' $5T Payment Ambition

Stablecoins have evolved from volatility solutions into global payment rails—yet their stability remains an illusion manufactured through centralized reserves and geopolitical maneuvering. As real-world asset (RWA) tokenization bridges TradFi and crypto, these digital dollars face existential tests from sovereign digital currencies like China’s e-CNY (1.5B+ transactions) and instant settlement systems like FedNow. Report 2 dissects how this clash threatens SWIFT’s $5 trillion cross-border empire.

DISCLAIMER

Chart of The Week: Sources: Bloomberg, Coindesk, Cointelegraph, Forbes, Rados.io, Linux Research

Market Cap & Trading Vol.: Sources: Coinmarketcap, Linux Research

Thought of The Week: Sources: AON, Bloomberg, Blockchain.com, CCN, Coindesk, Cointelegraph, Ethereum World News, Gemini, Insurance Journal, Los Angeles & San Francisco Daily Journal, Linux Research

Week Ahead: Sources: FxStreet.com, Linux Research

Weekly Recap: Sources: FxStreet.com, Linux Research

Past performance does not guarantee future results.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any cryptocurrencies. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

©Linux Group, October 2024.

Unless otherwise stated, all data is as of October 7, 2024 or as of most recently available.