WEEKLY RECAP

- U.S. Stock Losses: Major indexes dropped, with the Russell 2000 and S&P MidCap 400 down over 4% due to new tariffs and weak economic data.

- Weak Job Growth: Only 73,000 jobs were added in July, indicating a cooling labor market.

- Fed Rate Decision: The Federal Reserve kept rates steady, as inflation data rose.

- Eurozone Decline: European stocks fell after a disappointing U.S.-EU trade deal, despite stable inflation and GDP growth.

- Japan’s Market Drop: Japan’s stock markets declined, and the yen weakened, while the Bank of Japan raised inflation forecasts.

WEEKLY AHEAD

- August 5, 2025, Caixin, China Services PMI (July)

- August 5, 2025, USA Census Bureau, U.S. International Trade in Goods and Services (June)

- August 7, 2025, China National Bureau of Statistics, Trade Balance (July)

- August 7, 2025, China State Administration of Foreign Exchange, Foreign Exchange Reserves (July)

- August 7, 2025, USA Census Bureau, Monthly Wholesale Trade: Sales and Inventories (June)

MAJOR MARKETS

Name

Dow Jones

S&P 500

Nasdaq

Nikkei 225

HSI

SHI

Last Close

43,588.58

6,238.01

20,650.13

40,799.60

24,507.81

3,559.95

7D%

-2.92%

-2.36%

-2.17%

-1.58%

-3.47%

-0.94%

THOUGHTS OF THE WEEK

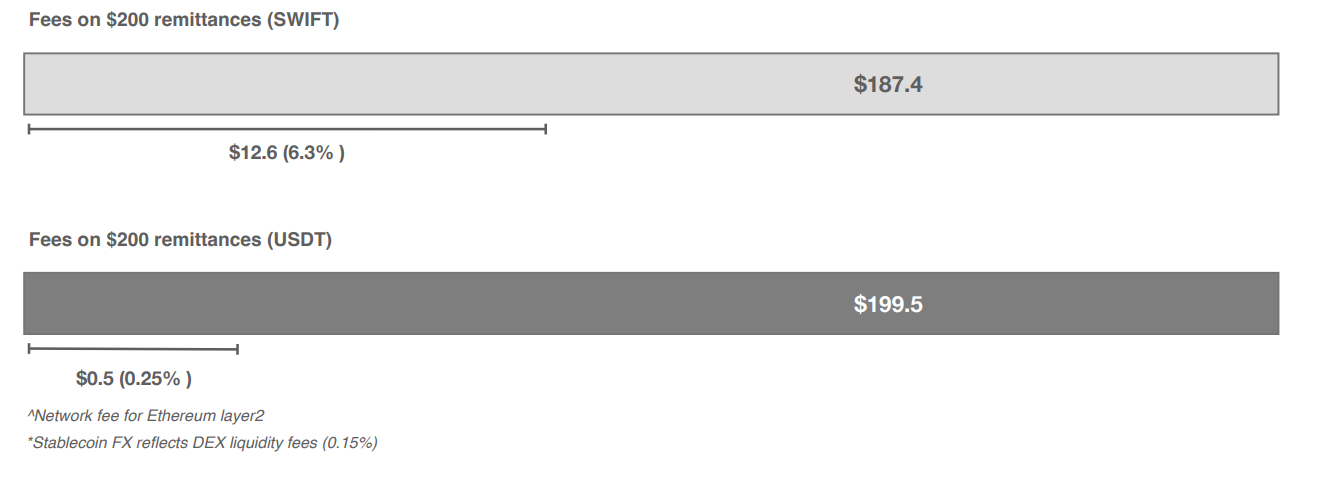

The most transformative application of stablecoins lies in cross-border transactions—a sector long paralyzed by the inefficiencies of SWIFT, the 50-year-old messaging network that controls 90% of global payment flows. While SWIFT’s cobwebbed architecture imposes punishing costs (6.3% fees on $200 remittances), days-long delays, and exclusion of 1.4 billion unbanked people, stablecoins offer a seismic alternative: settlements in seconds for pennies, accessible via any smartphone.

This clash isn’t merely technological but geopolitical. SWIFT’s weaponization in sanctions (e.g., Russia’s 2022 expulsion) accelerated demand for neutral rails—propelling stablecoin cross-border volume from near zero to $500 billion monthly in 18 months. Yet stablecoins face their own reckoning: regulatory landmines, reserve transparency wars, and SWIFT’s trillion-dollar institutional inertia.

I. Anatomy of SWIFT: The Messenger, Not the Money

Core Function: SWIFT (Society for Worldwide Interbank Financial Telecommunication) operates as a secure messaging network, not a settlement system. It transmits payment orders between 11,500+ financial institutions across 200+ countries using standardized codes (BIC/IBAN).

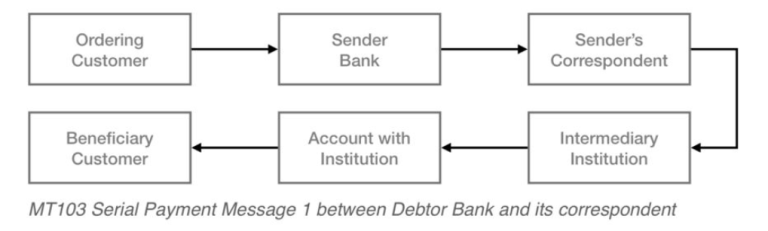

- Messaging Flow:

- Bank A (e.g., JPMorgan NY) sends MT103 (payment order) via SWIFT to Bank B (e.g., HSBC London).

- Funds move through correspondent banking: JPMorgan debits sender’s account → credits HSBC’s nostro account (pre-funded USD account at JPMorgan) → HSBC credits recipient.

- Volume: 50 million messages/day (2024), 90% for payments.

- Governance: Controlled by G10 central banks (Fed, ECB, BoJ).

II. The $45 Billion Annual Pain: Costs, Delays, Exclusion

A.Cost Structure

- SWIFT fee: $0.10-$1.50

- FX spread: 3-5%

- Correspondent fees: $15 – $50

(6.3% fees on $200 remittances), Source: World Bank 2024 Remittance Report

B.Speed Bottlenecks

- 3–5 Days Latency due to:

- Time-zone gaps (NY-London-Tokyo handoffs).

- Compliance checks (OFAC screening, AML holds).

- Nostro account reconciliation delays.

- Settlement Risk: $300B+ daily exposure in unresolved trades (BIS 2023).

C.Financial Exclusion

- 1.4B unbanked adults cannot participate (no KYC-compliant accounts).

- SMEs face 8.7% avg. fees for cross-border invoices (IMF).

III. Geopolitical Weaponization: Sanctions & Fragmentation

SWIFT’s G10 governance enables its use as a sanctions lever – seen in Iran’s 2012 disconnection and Russia’s 2022 expulsion. While alternatives like Russia’s SPFS emerged, they remain partially dependent on SWIFT infrastructure, exposing strategic vulnerability.

Key Events:

- 2012: Iran disconnected from SWIFT (nuclear sanctions).

- 2022: 7 major Russian banks removed (Ukraine invasion).

- 2024: 63 Russian entities still accessible via SPFS-SWIFT bridges.

Impact:

- Russia’s SPFS usage grew 12x (2022–2024), now 25% of domestic traffic.

- China’s CIPS processed $22T in 2023 (+44% YoY), but 80% still relies on SWIFT for final settlement.

IV. Alternatives: Progress and Limitations

China’s CIPS ($22T/year) and Russia’s SPFS ($15B/day) offer regional alternatives but still route 80% and 40% of messages through SWIFT. New systems like FedNow avoid SWIFT but lack global reach, perpetuating fragmentation.

System

CIPS (China)

SPFS (Russia)

FedNow

UPI (India)

Volume (2024)

$22T/year

$15B/day

$25B/day

$4T/year

Key Features

Real-time RMB settlement

SWIFT-compatible API

24/7 USD instant settlement

Domestic real-time network

CHAT OF THE WEEK

V. Why SWIFT Persists: The Inertia Trap

Regulatory Capture

- G10 Central Bank Control: Fed/ECB veto power over SWIFT board decisions.

- Lobbying: $26M/year spent by SWIFT-affiliated banks to block payment reforms (Open Secrets 2023).

B.Institutional Inertia

- Integration Costs: $20M+/bank to adopt alternatives.

- Network Effects: 50 years of protocol standardization (MT/ISO 20022).

- Risk Aversion: 93% of banks prefer “known flaws” over untested systems (McKinsey 2024).

C.Structural Dependencies

- USD Hegemony: 88% of trade finance uses USD, forcing reliance on U.S. correspondents.

- Nostro Gridlock: $12 trillion parked in idle nostro accounts (30% of global bank capital).

VI. The Future: Disruption Scenarios (2025–2030)

Scenario

Slow Evolution

Fragmentation

Collapse

Outcome

SWIFT integrates CBDCs/stablecoins but retains messaging monopoly

Bloc-based systems emerge (CIPS for BRICS, FedNow for G7)

Stablecoin/CBDC rails bypass SWIFT; daily volume drops 60%+ by 2030

DISCLAIMER

Chart of The Week: Sources: Bloomberg, Coindesk, Cointelegraph, Forbes, Rados.io, Linux Research

Market Cap & Trading Vol.: Sources: Coinmarketcap, Linux Research

Thought of The Week: Sources: AON, Bloomberg, Blockchain.com, CCN, Coindesk, Cointelegraph, Ethereum World News, Gemini, Insurance Journal, Los Angeles & San Francisco Daily Journal, Linux Research

Week Ahead: Sources: FxStreet.com, Linux Research

Weekly Recap: Sources: FxStreet.com, Linux Research

Past performance does not guarantee future results.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any cryptocurrencies. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

©Linux Group, October 2024.

Unless otherwise stated, all data is as of October 7, 2024 or as of most recently available.