WEEKLY RECAP

- U.S. Market Rebound: U.S. equity indexes rose, with the Nasdaq Composite hitting a record high, fueled by Apple’s major investment in U.S. manufacturing.

- Fed Rate Cut Likelihood: Expectations for a Federal Reserve rate cut in September increased as officials noted a slowing labor market.

- Bank of England Lowers Rates: The Bank of England cut its key rate to 4% amid labor market concerns, predicting inflation to rise to 4% in September.

- Japan’s Market Gains: Japan’s stocks rose on positive earnings and trade tariff clarifications with the U.S., while the Bank of Japan considered future rate hikes.

- China’s Export Surge: Chinese markets improved as July exports rose 7.2%, despite declines in U.S. shipments, indicating a recovery in the services sector.

WEEKLY AHEAD

- August 13, 2025, China National Bureau of Statistics, Vehicle Sales (Year-on-Year)

- August 14, 2025, China National Bureau of Statistics, Total Social Financing

- August 15, 2025, China National Bureau of Statistics, House Price Index (Year-on-Year)

- August 15, 2025, China National Bureau of Statistics, Industrial Production (Year-on-Year)

- August 15, 2025, USA Census Bureau, Retail Sales (July)

MAJOR MARKETS

Name

Dow Jones

S&P 500

Nasdaq

Nikkei 225

HSI

SHI

Last Close

44,175.61

6,389.45

21,450.02

41,820.48

24,858.82

3,635.13

7D%

1.35%

2.43%

3.87%

2.50%

1.43%

2.11%

THOUGHTS OF THE WEEK

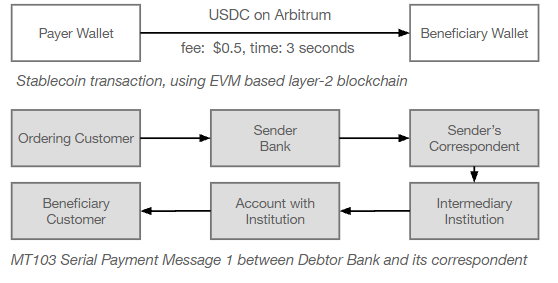

Stablecoins represent a fundamental shift in cross-border value transfer by collapsing the traditional multi-layered financial messaging system (SWIFT) and correspondent banking into a single-layer, blockchain-native settlement rail. Unlike fiat transactions, which rely on fragmented legacy infrastructure, stablecoins like USDC or USDT settle peer-to-peer in seconds using cryptographic verification, eliminating intermediaries, nostro accounts, and reconciliation delays.

I. The Efficiency Advantage

When transferring $200 across borders, stablecoins reduce costs by 25x compared to SWIFT (averaging $0.50 vs. $12.60, ref: linux research 04 AUGUST 2025) and accelerate settlement from days to seconds. This stems from three innovations:

- Near-zero FX spreads: Decentralized exchanges (DEXs) enable currency conversion at 0.5% fees versus banks’ 3–7%.

- No network tolls: Blockchain messaging fees are negligible ($0.05) versus SWIFT’s $3.50 per transaction.

- Disintermediation: Cutting correspondent banks removes hidden routing fees.

II. Friction Points in Practice

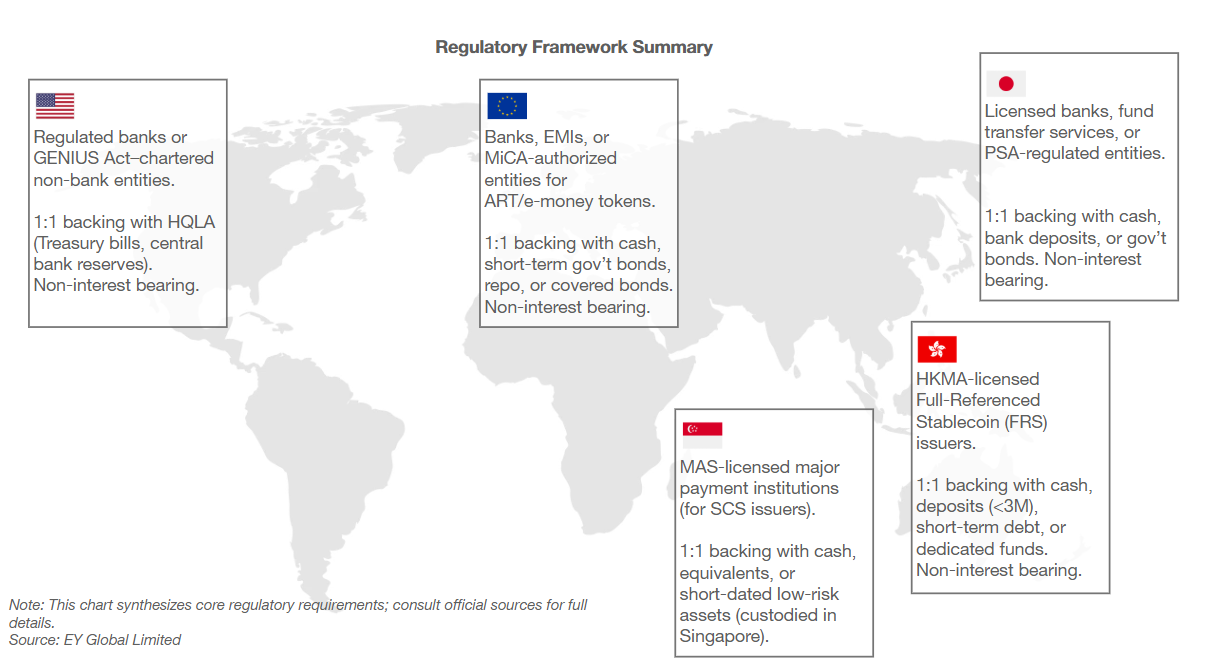

Regulatory Fragmentation:

- The EU’s MiCA framework licenses stablecoins but imposes 1:1 euro reserves and transaction caps.

- Nigeria banned crypto after stablecoin usage spiked 310% in 2023, fearing naira depreciation.

Technical Barriers:

- On-Ramp Costs: Converting USD to USDT averages 1% on exchanges.

- Wallet Complexity: 72% of non-users cite private key management as adoption blocker (Binance Survey).

- Scalability: Ethereum handles 30 TPS (theoretical max TPS:119); Visa handles 65,000 TPS — a gap Layer-2 solutions (Arbitrum max TPS: 6,000) aim to close.

III. Real-World Use Cases – Breaking Through

The Underground Economy’s “Dollar 2.0”

- Why it thrives: Pseudonymity + stability make stablecoins ideal for discreet commerce. Unlike Bitcoin’s volatility, a $100 USDC payment retains its value.

- Evolving use: Beyond illicit activity, freelancers in sanctioned regions (e.g., Iran, Russia) use USDT to receive payment for legitimate remote work, bypassing SWIFT blocks.

Cross-Border Payments: From Niche to Mainstream

- Explosive growth: Monthly stablecoin remittances surged from near-zero to $500B in 18 months (Circle, 2024), growing at 22% MoM.

- Corporate adoption:

- Amazon pays suppliers in USDC across LATAM/SEA, cutting 4-day delays to 8 seconds.

- Walmart uses USDT for intra-Asia logistics settlements, reducing fees by 87%.

Hyperinflation Havens: Digital Dollarization

- Survival tool: In Argentina (2023 inflation: 211%), stablecoins became de facto “digital dollars”:

- Rent payments: 12% of Buenos Aires leases now priced in USDC (La Nación, 2024).

- Salary bypass: Employers convert collapsing pesos to USDT for staff—avoiding 10% daily devaluation.

- Government U-turns:

- Nigeria reversed its crypto ban after stablecoin demand spiked 310% post-naira crash.

- Brazil integrated USDC into Pix (instant payment system), allowing 1-click conversions at central bank rates.

Corporate Treasury Revolution

- Trapped capital unlocked: Multinationals like Mercado Libre hold reserves in USDC, slashing liquidity costs by 40%.

- Just-in-time payments: Vietnamese coffee exporters receive USDC from EU buyers in 3 minutes (vs. 14 days via letters of credit), freeing up $7M/month in working capital.

Use Case

CIPS (China)

SPFS (Russia)

FedNow

UPI (India)

Scale

$500B/month (growing 22% MoM)

40% of Argentine crypto volume

$9B/month (BlackRock, Amazon)

$24.2B (2023)

Impact

Saves users 5-7% per $200 transfer

Preserves 90%+ value vs. local currency

Cuts settlement from days to seconds

0.34% of total stablecoin volume

CHAT OF THE WEEK

IV. The Path to Mass Adoption – Clearing the Hurdles

Regulatory Harmonization:

FATF’s “Travel Rule” compliance tools (e.g., TRP Solutions) must achieve 95%+ jurisdiction coverage.

Standardized reserve audits (e.g., Circle’s monthly attestations by BDO) to prevent TerraUSD-style collapses.

User Experience Revolution:

Self-custody solutions: MetaMask’s “smart wallets” eliminate seed phrases with social recovery.

Fiat integration: Brazil’s Pix instant-payment system now links to Mercado Bitcoin for 1-click stablecoin buys.

Institutional Onboarding:

BlackRock’s BUIDL fund holds $382M in USDC for treasury operations—a blueprint for corporations.

Visa’s USDC settlement pilot processed $10B in 2023, proving bank-grade scalability.

V. The Bottom Line

Stablecoins aren’t just cutting costs — they’re redefining sovereignty. By enabling frictionless cross-border value flow, they challenge state control over capital and monetary policy. SWIFT’s 54% market share in payments (McKinsey) now faces an existential threat: adapt to blockchain rails or become obsolete. The winners will be those who harness stablecoins not as cryptocurrencies, but as programmable dollars that turn borders into speed bumps.

DISCLAIMER

Chart of The Week: Sources: Bloomberg, Coindesk, Cointelegraph, Forbes, Rados.io, Linux Research

Market Cap & Trading Vol.: Sources: Coinmarketcap, Linux Research

Thought of The Week: Sources: AON, Bloomberg, Blockchain.com, CCN, Coindesk, Cointelegraph, Ethereum World News, Gemini, Insurance Journal, Los Angeles & San Francisco Daily Journal, Linux Research

Week Ahead: Sources: FxStreet.com, Linux Research

Weekly Recap: Sources: FxStreet.com, Linux Research

Past performance does not guarantee future results.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any cryptocurrencies. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

©Linux Group, October 2024.

Unless otherwise stated, all data is as of October 7, 2024 or as of most recently available.